Post-demonetisation, many online frauds are coming to light and police stations are getting complaints of people losing their life’s savings to tricksters. Is India prepared for digitisation?

~By Karan Kaushik

Call it the dark side of going cashless. Post-demonetisation with the government urging people to use plastic money for transactions, police stations across Delhi are getting complaints from those who have lost money from their bank accounts and ATMs to tricksters.

Two patterns of frauds are emerging. One involves tricksters calling up account holders and claiming they are RBI or bank officials and demanding that the passwords of debit/credit cards be shared with them to attend to a complaint. Those who share these confidential details soon find that they have been conned as they receive a text message from their bank informing them that money has been withdrawn from their account. Even educated people have been found vulnerable.

The other fraud involves tricksters depositing huge amounts of cash into the accounts of unsuspecting people. When the latter go to withdraw money, they are informed that their account has been blocked because there has been a huge inflow of cash which is under investigation. The money ranges from a few lakhs to Rs 50 lakh. Panic-stricken citizens have no choice but to approach the police.

FROZEN ACCOUNTS

Activist and writer Hema Mehra was appalled when her cook, Anil, returned home with a sulking face and told her that his Jan Dhan account was frozen by his bank. Anil has an account with the State Bank of India in Delhi’s Raghubir Nagar. After the note ban, Mehra used to pay Anil’s salary of Rs 6,000 through cheque. He went and deposited the cheque in the bank but two days later, when he went to withdraw the money from his ATM, his account was not functioning. When he enquired with the bank, he was in for a shock. He was told that his account had been frozen as there was an unaccounted deposit of Rs 21 lakh in it and the bank had sent a letter to his home questioning how this amount had come into his account.

On requesting the bank, the Rs 6,000 was returned to Anil by a banker’s cheque (given to this individual from the bank’s account. The bank will recover it as and when the case is solved). The bank told him that he should not worry as the matter would be sorted out in two to three months. His account would then start functioning again. Meanwhile, he should open another account for his salary.

Prior to the deposit of Rs 21 lakh into his account, Anil had saved Rs 50,000 in his bank but due to his account being frozen, he was not given access to his own savings. Strangely enough, no intimation of the Rs 21 lakh deposit was sent to him by the bank and it also refused to update his pass book. The bank staff told him that there were many such deposits in Jan Dhan accounts and all were frozen.

CLERICAL MISTAKE?

When India Legal phoned the SBI branch manager in Raghubir Nagar, he rubbished the entire fraud, calling it a clerical mistake. He said that Anil did not approach the branch regarding this and that KYC details of Anil’s account were not updated and that is why his account was blocked. Asked how the bank did not have any information regarding the Rs 21 lakh deposited in Anil’s account, he, in turn, asked how the bank could have such information. He said there was no entry in November in Anil’s account. As for the letter sent by the bank to Anil’s address, he said incredulously that it might have been sent by mistake.

As for the bank being vigilant about money being deposited in accounts, he said: “Who are we to question anyone about their money and its source?” Asked what should be the bank’s role in such a scenario, he said: “The bank’s duty is just to report to its controller.” Asked if similar cases had come to his notice, he hung up saying he would not be able to talk any further on this matter.

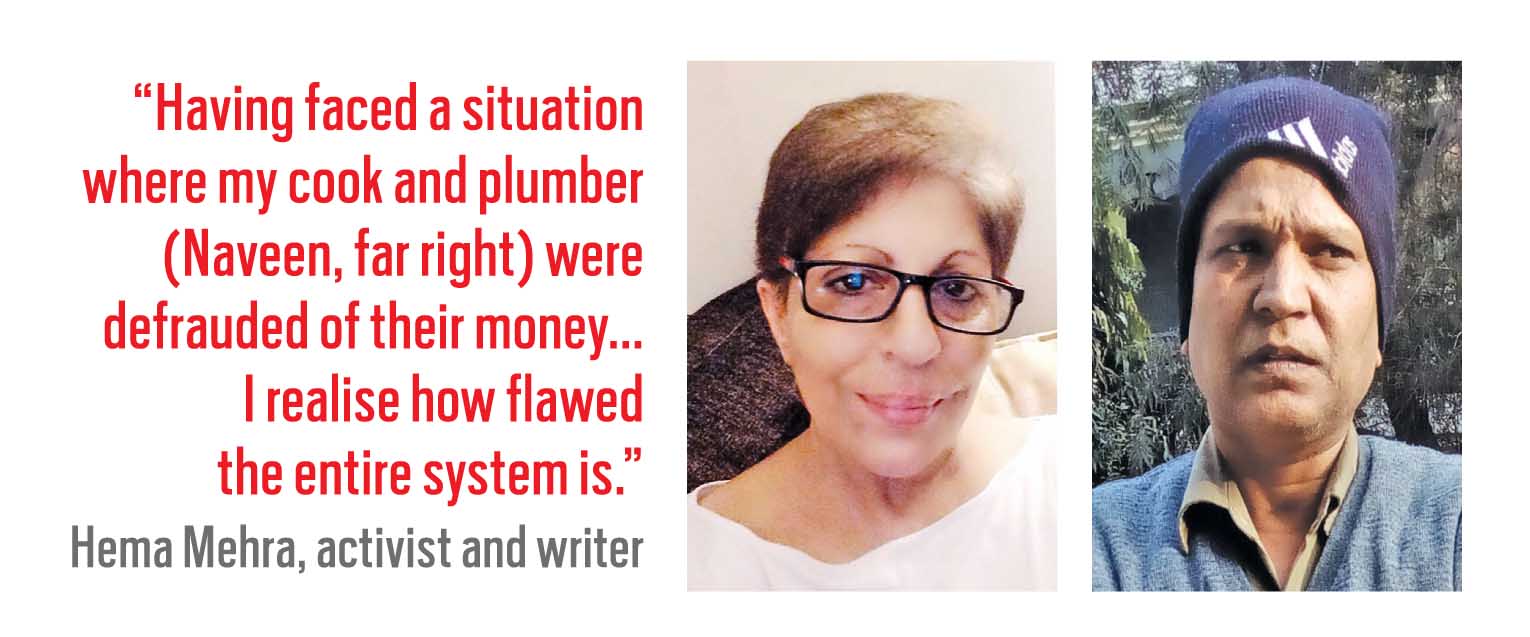

Anil is not the only employee of Mehra who landed in a financial mess. Her plumber, Naveen, and his wife, Geeta, have accounts with the Bank of Baroda’s Bharat Nagar Branch. Naveen had filed an application for renewal of Geeta’s ATM card as it was not working. When he went to the bank to inquire, a bank official told him that the card would be delivered to his address within two days or he would get a call from the bank. Some 15 minutes later, Geeta got a call from one Ravi Kumar who said he was a bank officer with the Bank of Baroda. He told Geeta that as she had applied for reactivation of her card, she needed to reconfirm her card number. She handed the phone to Naveen. Thinking it was a genuine call because the caller knew all the details of his wife applying for a new card, he gave the card number.

LEAKY BANK

Within five minutes, Naveen started getting messages on his phone saying that money was being debited from his account. When he called the number, the person on the other side told him that it was only a bank entry and that the money would be credited back. Naveen smelt a rat and rushed to his bank and got the account frozen. But it was too late; the money had been debited. It was obvious that there was a leak in the security system of the Bank. Otherwise, how could the caller know about Geeta’s card needing reactivation, her mobile number and Naveen being an account holder in the same bank?

Mehra told India Legal: “It is appalling to see how different categories of people are treated by bank officials. When I, a privileged and educated woman, went to the bank, I was immediately offered a chair and a cup of tea by the manager despite not having an account there, while Naveen and Geeta were made to stand. I am also tech-savvy enough to understand that cyber crimes can be solved.”

The bank refused to help resolve Naveen’s issue. No effort was made by it to report the matter. However, threats by Mehra, a social activist, to make the story public, to put the bank under scrutiny and to file an FIR worked. The bank’s complacent attitude changed overnight to one of cooperation. With a police complaint filed within the first few hours of the crime being committed, the money was traced and credited to Naveen’s account.

“Having just faced a situation where my cook was defrauded of his entire life’s hard-earned money, thanks to being forced to use an ATM card, I begin to realise how flawed and heartless the entire system was,” said Mehra. “The underprivileged have no voice, and even if they did, they have little knowledge of how to fight a cold banking system that will not cooperate, offer advice or help.”

VULNERABLE LOT

Naveen and Geeta were not the only ones who were fooled. Sudheer Yadav works as a driver with senior sports editor Krishnaswami and has an account with the Bank of Maharashtra. Yadav got a call saying that his ATM card had been blocked. He was surprised as he had used the card just two days back. On being asked how, the caller said all the details would be shared provided Yadav told him the card number. Yadav innocently gave the number. He was asked his card’s expiry date and CVV number. He gave that too. Soon, Rs 16,000 was withdrawn from his account. When he called back on the number, no one answered. Yadav filed an FIR with the Gurgaon Police.

The police, too, is waking up to these frauds. In Naveen’s case, the police was helpful in getting his money back. A senior police officer at the New Friends Colony Police station where Naveen registered a case said that when money is debited from an account and credited into another, it stays in the second account for 24 hours.

Cyber cell expert Krishna Chaudhary helped the police in tracking the account into which Naveen’s money was credited. The cell blocked the account with the help of the concerned bank so that the money was retrieved. The police official said that such fraud cases had reduced after bank advisories saying that one should not reveal one’s card or account details.

He said that most of the phone numbers from which such calls were made were based on fake identities. “Fifty percent of SIM cards in Delhi are issued on fake identity cards as there are no strict rules and regulations by the government.” He said the police was becoming tech-savvy and was confident of tracking such cases. “We make our department aware of cases involving such frauds and how to deal with them,” he added.

In a country where the vast majority of the population is semi-educated and illiterate, digitalising the nation seems like a cruel joke. It is so easy to take them for a ride and make their life’s savings disappear. Online security experts suggest that India needs a privacy law and also one that deals with disclosure of data breaches. Banks don’t tell their customers that their data is breached for obvious reason. But don’t banks have a responsibility towards their account holders?

Neeraj Arora, a cyber lawyer and expert, said: “We just do not have the infrastructure to deal with IT offences. Only in the metros do we have something called a cyber cell. Till now, the police was able to catch only the ‘carriers’ —those whose accounts are used for transfer and withdrawal of money. They have no knowledge of the offence. The main gang never falls into the police ambit. The police is also unable to get any admissible evidence. Electronic evidence is very fragile.”

Indians are being exhorted to adopt e-platforms at a fast pace, but where is the security? With a semi-literate population that is bewildered and overwhelmed by the sudden turn of events, banks need to educate them by holding demo classes on safe banking. Banks too need to be educated on how to deal with their customers.

Otherwise, Digital India will remain a pipe dream.