A petition has been filed in the Supreme Court opposing the extension of six months granted to the Securities and Exchange Board of India (SEBI) for completion of its probe into the allegations made by US-based short seller firm Hindenburg Research against Adani group of companies over stock price manipulation.

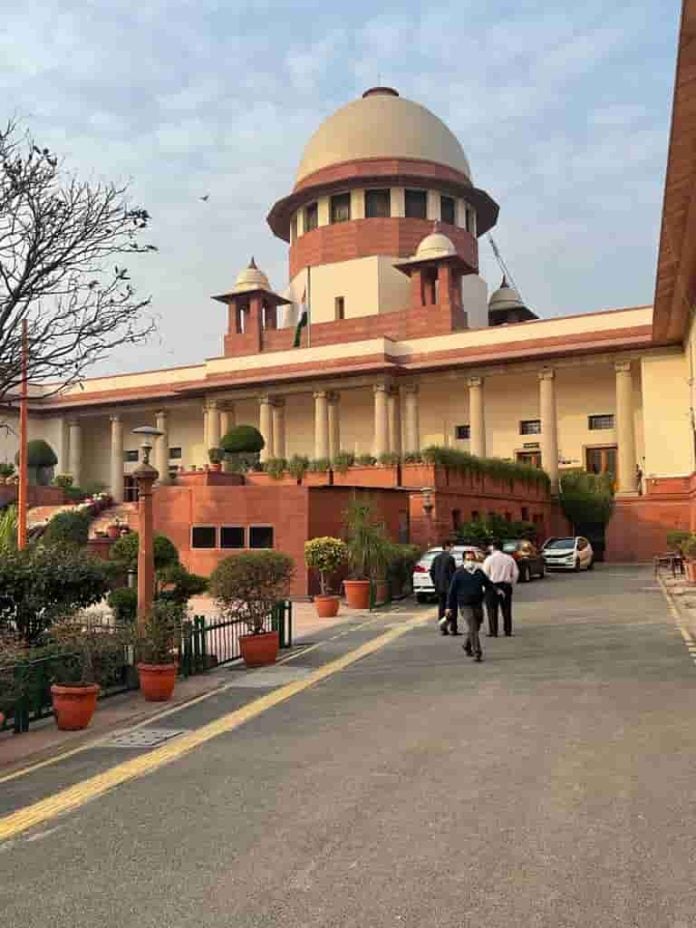

Filed by Vishal Tiwari, the petition sought directions for the market regulator to complete the investigation within the stipulated time and file a report before the Apex Court.

It urged the top court of the country not to extend the time granted originally to SEBI for completion of investigation into the Hindenburg report case.

Earlier on April 29, the market regulator had sought extension of six months to complete investigation into the controversy related to the Hindenburg Research report on Adani Group of companies and the allegations surrounding it.

As per SEBI, the 12 suspicious transactions cited in the Hindenburg report would need a rigorous probe since the complex transactions were having many sub-transactions.

Earlier on March 2, the Apex Court had directed the market regulator to finish the probe by May 2. This was in addition to the investigation ordered by the Apex Court, to be conducted by an expert committee headed by retired apex court judge, Justice AM Sapre.

SEBI submitted on April 29 that it would need another six months to complete the probe. It apprised the expert committee of the status, steps taken and interim findings in respect of the examinations and investigations carried out by it.

In its application, the market regulator submitted that the 12 suspicious transactions cited in the Hindenburg report would need a rigorous probe of at least 15 months since those transactions are complex and have many sub-transactions.

The probe would further require obtaining bank statements from multiple domestic as well as international banks and as the bank statements would also be for the transactions undertaken more than 10 years ago, this would take time and be challenging, noted the petition by SEBI.

It further said the process of seeking bank statements from the offshore banks would entail taking assistance from offshore regulators, which may be time consuming and challenging. However, the market regulator said it would try to complete the process in six months.

The market regulator listed three broad categories, under which the transactions requiring more time would fall:

(i) Those where prima facie violations have been found and a period of 6 months would be required to arrive at conclusive finding

(ii) Those where prima facie violations have not been found, a period of 6 months would be required to revalidate the analysis and arrive at conclusive finding

(iii) In cases where further examination/investigation is required and most of the data that is required for this purpose is expected to be reasonably accessible, a conclusive finding is expected to be arrived at in six months.