A five-judge bench comprising Chief Justice of India D.Y. Chandrachud Justice Sanjiv Khanna, Justice B.R. Gavai, Justice J.B. Pardiwala, and Justice Manoj Misra will hear the bunch of petitions which challenged the validity of the Centre’s electoral bonds scheme as a source of political funding from October 31.

Earlier, the matter was mentioned before a 3-judge Bench headed by CJI Chandrachud, which decided to refer it to a five-judge Bench in view of Article 145(4) of the Constitution, apart from the importance of the issue raised in the petitions. The Apex Court said that the matter will be retained on the board on October 30.

The petitions challenged the amendments introduced by the Finance Act 2017, which paved the way for the anonymous electoral bonds scheme.

The Supreme Court had agreed last week to hear the pleas filed in 2017 after the petitioners urged the matter be heard before the upcoming general elections.

Filed by the Communist Party of India (Marxist), along with NGOs Common Cause and Association for Democratic Reforms (ADR), the petitions challenged the scheme on the grounds that it was an ‘obscure funding system,’ which would remain ‘unchecked’ by any authority.

As per the petitioners, amendments to the Companies Act 2013 would lead to ‘private corporate interests’ taking precedence over the needs and rights of people of the State in policy considerations.

What is an electoral bond?

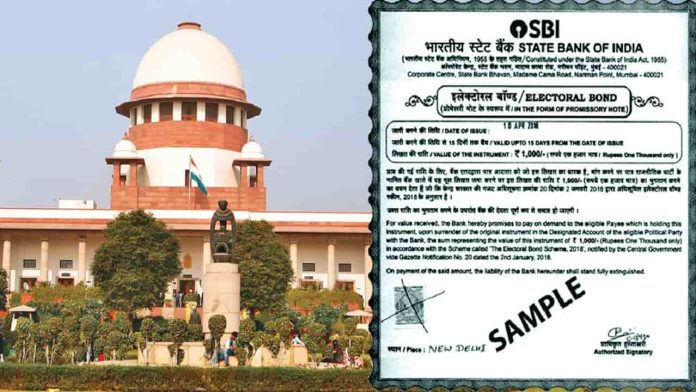

An electoral bond is an interest-free promissory note payable to the bearer on demand after any Indian citizen or a body corporate in India buys it. The bond can be cashed within 15 days through the party’s verified account.

Political parties were not required to disclose the source of these bonds to the Election Commission of India (ECI). The bonds can be bought for any value, in multiples of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh or Rs 1 crore.

The name of the donor will not be there in the bond. The face value of the bonds shall be counted as income by way of voluntary contributions received by an eligible political party, for the purpose of exemption from Income Tax under Section 13A of the Income Tax Act, 1961.

This scheme was introduced through the Finance Act, 2016 and the Finance Act, 2017.

The Finance Act had introduced amendments in 2017 in the Reserve Bank of India Act, the Companies Act, the Income Tax Act, the Representation of Peoples Act and the Foreign Contributions Regulations Act, to make way for the electoral bonds.

Political parties have criticised the anonymous nature of the bonds since it allowed corporates to fund politicians who can serve their interests.

By virtue of the 2017 amendment made to Section 29C of the Representation of Peoples Act 1951 (RPA), a donor may buy an electoral bond at specified banks and branches using electronic modes of payment and after having completed the KYC requirements.