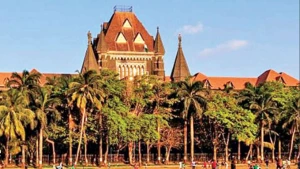

The Bombay High Court has refused to intervene in a challenge mounted by Reliance Communications promoter Anil Ambani against the State Bank of India’s (SBI) decision to categorise his loan account as fraudulent, marking a significant setback for the industrialist in his ongoing battle with lenders. A division bench comprising Justices Revati Mohite Dere and Neela Gokhale dismissed Ambani’s writ petition after concluding that the bank’s action was in conformity with the Reserve Bank of India’s regulatory framework, specifically the Master Directions on fraud risk management issued in July 2024.

Ambani had urged the court to quash SBI’s classification on the grounds that it was procedurally flawed and legally untenable. His counsel submitted that during the period when the alleged irregularities took place, he held only a non-executive director position and was not involved in the day-to-day management of Reliance Communications or its associated companies. He further argued that he had been denied natural justice, as SBI had not given him a meaningful opportunity of being heard before passing its order. According to him, several documents relied upon by the bank to support the fraud classification were either not disclosed to him at all or were shared belatedly, depriving him of the ability to effectively respond to the allegations.

The court, however, was not persuaded by these arguments. It noted that SBI’s decision followed the prescribed procedures under the RBI framework and that the allegations of violation of natural justice were unsubstantiated. The bench emphasised that Ambani’s writ petition could not be entertained merely on the basis of his claim that he was a non-executive director, since the fraud classification related to systemic lapses in fund utilisation and compliance obligations attributable to the company and its promoters. The judges observed that once the bank had acted within the contours of the RBI’s directions, the scope for judicial interference was narrow.

SBI had, in June 2025, formally declared the loan accounts of Reliance Communications and Ambani as fraudulent, citing serious financial irregularities. The bank’s internal review flagged diversion of borrowed funds, breaches of loan covenants, and opaque related-party transactions that allegedly impaired the bank’s ability to recover its dues. Following the classification, SBI notified the Reserve Bank of India and also initiated steps that could trigger a criminal investigation into the transactions. The designation of an account as “fraud” has severe consequences, as it not only exposes the borrower and its management to potential criminal liability but also places restrictions on future access to credit and restructuring schemes.

Ambani’s challenge to SBI’s decision was not his first encounter with such allegations. Earlier, Canara Bank had also categorised his account as fraudulent. In that case, the Bombay High Court had initially stayed the bank’s action, noting that it appeared to have been taken without providing a proper hearing to the borrower. Subsequently, in July 2025, Canara Bank withdrew its fraud classification, leading the High Court to dispose of the petition as infructuous. Against this backdrop, the outcome of Ambani’s case against SBI assumed particular significance, as it tested the consistency of judicial review standards in fraud classification matters.

By dismissing Ambani’s plea, the High Court has effectively reinforced the authority of banks to exercise their regulatory prerogatives under the RBI’s framework, provided the due process prescribed therein is followed. The order also signals to corporate borrowers that the courts are unlikely to interfere with bank decisions unless a clear case of procedural violation is demonstrated. For Ambani, the decision represents a legal blow that may complicate his financial dealings further, especially as fraud classifications are likely to impact both his personal credibility and his group’s ability to secure refinancing.

The judgment thus adds a new dimension to the broader narrative of regulatory tightening in India’s banking sector, where lenders have been increasingly proactive in classifying troubled accounts in accordance with the RBI’s guidelines and initiating follow-up enforcement action. It also highlights the judiciary’s deference to regulatory processes in matters involving high-value loan accounts and corporate governance, underscoring that promoters cannot easily shield themselves from liability by relying on their titular roles or by alleging inadequate disclosure at a later stage.