By Dr Swati Jindal Garg

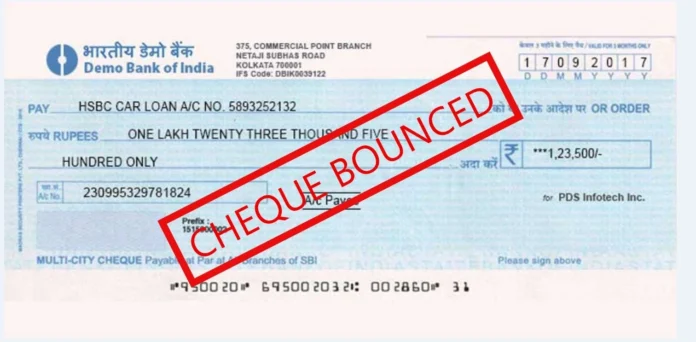

Proving yet again that in law, the letter truly lays down the rule, the Supreme Court has delivered a significant judgment emphasizing strict compliance with the Negotiable Instruments Act (NI Act).

The apex court has ruled that any incorrect mention of the cheque amount—even a typographical error—in the statutory notice issued in cheque bounce cases is fatal to the validity of the notice and, consequently, to the entire prosecution.

The ruling came from a bench, comprising Chief Justice of India BR Gavai and Justice NV Anjaria, who reaffirmed that under Proviso (b) to Section 138 of the NI Act, the demand notice sent to the cheque issuer must specify the exact amount stated on the dishonoured cheque. Any variation, whether deliberate or accidental, will invalidate the notice and cause the case to collapse.

STRICT COMPLIANCE IS NON-NEGOTIABLE

Section 138 of the NI Act provides for criminal action against a person whose cheque is dishonoured due to insufficient funds. To maintain such an action, the payee (a person, company, or entity named on a cheque who is entitled to receive the funds specified in it) must issue a demand notice to the drawer (the person who writes and signs the cheque) within 15 days of the cheque being returned unpaid.

“When the provision is penal and the offence is technical, there is no escape from holding that the ‘said amount’ in proviso (b) cannot be any amount other than that mentioned in the cheque,” the bench observed. “Even mentioning an omnibus amount in the notice does not fulfil the legal requirement.”

In a move that removes any room for flexibility, the Court further clarified that even if the cheque details are correctly mentioned, but the corresponding amount is wrong, the notice remains invalid. The principle of “reading the notice as a whole” does not apply here, the Court said, calling for a “strict and technical interpretation” of the law.

THE CASE THAT TRIGGERED THE RULING

The judgment arose from an appeal filed by Kaveri Plastics, involving a cheque issued for Rs one crore in 2012 that was dishonoured for “insufficient funds”. The complainant’s legal notice, however, mistakenly demanded payment of Rs two crore, double the cheque amount.

The High Court had earlier quashed the complaint, ruling that the notice was invalid due to the discrepancy. Kaveri Plastics argued before the Supreme Court that the difference was a typographical error and that a hyper-technical approach should not defeat the substance of justice.

The company contended that upholding such a rigid view would unfairly benefit dishonest drawers of cheques. The respondents, however, maintained that the incorrect amount was deliberately inflated.

COURT’S INTERPRETATION AND ITS CONSEQUENCES

The Supreme Court sided with the High Court, reiterating that the cheque amount is one of the main ingredients of the offence under Section 138. If that ingredient is not met, the proceedings “fall flat as bad in law”.

“The notice demanding the payment of the amount covered by the dishonoured cheque is an essential component of the offence,” the bench noted. “Any discrepancy between the cheque amount and the amount demanded invalidates the notice, nullifying the entire prosecution.”

The apex court also clarified that after mentioning the exact cheque amount, a complainant is free to additionally claim legal fees, interest, or notice charges—provided the cheque amount is distinctly specified.

NO MORE EXCUSES FOR “INADVERTENT ERRORS”

This judgment delivers a strong message to those who have relied on the plea of “inadvertent error” in drafting demand notices. The Supreme Court has made it clear: the law does not tolerate elasticity when it comes to penal provisions.

By reaffirming the importance of precision, the Court has set a precedent that will shape cheque dishonour prosecutions going forward—leaving no room for typographical leniency.

—The author is an Advocate-on-Record practising in the Supreme Court, Delhi High Court and all district courts and tribunals in Delhi