When dealing with the MA indicator, you can create any type of trading strategy, including those following the trend, as well as some tactics to find the reverse entry points. Moving Average is applicable on its own, but the best tactics include various technical indicators and graphic tools to be even more effective and profitable.

Simple MA Strategies

One of the easiest yet most effective strategies is trading tactics where you can use two MAs with different periods. Normally, those strategies involve two Simple Moving Average indicators (SMA50 and SMA200). Signals come from the SMAs crossover.

Once both SMAs cross each other, you should check the position of the price related to the SMAs. If the price is above both Simple Moving Average indicators, this is the bullish signal. Otherwise (when the price is below both SMAs), the signal is bearish.

Another simple strategy that you can use to find entry points is the Moving Average envelope. This indicator uses a standard Simple or Exponential Moving Average. The envelope borders are drawn at a percentage distance from the indicator itself. The SMA or EMA indicator remains in the middle of the envelope.

Also Read: What to Choose: Investing vs trading

Normally, the price stands within the envelope, fluctuating between the envelope borders and the middle SMA or EMA. All those curves act as signal lines for traders. Once the price reaches the Moving Average indicator or one of the borders of the envelope, a signal comes.

Combining MA with Other Trading Tools

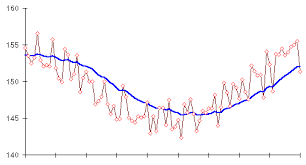

Moving Average strategy can be more complex. For instance, you can add other indicators or graphic tools to improve your trading results. Some tactics are designed to use Moving Average as an additional indicator to smooth price fluctuations data and illustrate it as a simple line on the chart.

Also Read: OctaFX Minimum Deposit: A Brief Review of the Broker’s Features

MA can be combined with both trend following and oscillator indicators. If you are using RSI, as your main reverse indicator, you can add the Moving Average indicator to see if there is a general reverse on the chart, or you are witnessing a correction and the trend will restore once this correction is over.

The MA indicator can also be used as an alert for the trader to fix its positions. If, for instance, the price breaks down or out a long period MA indicator, you should better close your buy or sell trades.