The method of using moving averages is one of the most important parts of technical analysis, especially if you’re just a newcomer to the Forex market. It can be extremely useful, but that’s why you need to understand how it works. That’s why we’re going to explain you what is this indicator, how it works, and when you should use it to predict the market behavior.

A moving average (MA) is a method employed by Forex traders to determine the direction of a price trend over a certain period of time. The strategy based on monitoring the moving average is rather popular in technical analysis with both intraday traders and long-term investors, and understanding this strategy is crucial for every newcomer to the Forex market.

How does it work?

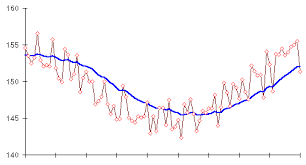

The strategy works because of the ability of moving averages to smooth out market trends and show them more clearly without all the random noise. This indicator was invented back in the early 1900s, and it has been used by statisticians and investors ever since. The moving average is a useful indicator that signals you when to make decisions.

Basically, the method is all about analyzing the averages. These averages are usually obtained as a result of summing up the data points of an asset and then dividing this sum by the number of points over the period we’re currently analyzing. This way we can avoid including a variety of random short-term price fluctuations in our decision-making process.

Moreover, moving averages allow traders to take volatility into account, making decisions less dependent on those random surges in prices. MAs look like squiggly lines on price charts that more or less closely follow the movement of the candlestick pattern. Since they represent just the averages, they tend to change as the overall level of price changes.

MAs are also known as lagging indicators since they tend to pursue the behavior of the prices of a certain financial asset. That means they can be used to analyze and predict the direction it goes. Alright, we’ve talked about what is a moving average, now let’s check out its major pros and cons.

Pros and cons

The greatest thing about MAs is that they can be used to make decisions. They smooth out the majority of random fluctuations to make the trend more obvious. MAs can also be used to see areas of support and resistance for trends without a clear direction. Moreover, they are simple enough even for newbies.

However, a moving average is not a magic solution. It does not take fundamental factors into account, and they can be really influential. And the method tends to miss any fluctuations that may not be noise-related, like seasonal patterns.