By Shivanand Pandit

For many years, every government has attempted decreasing the rules and regulations surrounding doing business in India. However, according to the latest report by TeamLeaseRegTech, a company enabling ease of doing business, and Observer Research Foundation, among the 69,233 exclusive compliances that govern doing business in India, there are 26,134 imprisonment clauses or fines for non-compliance with business laws legislated since Independence. In other words, nearly 38% of compliances can send a businessperson to jail.

According to the report, the five most industrialised states have over 1,000 imprisonment clauses in their business laws— Gujarat (1,469), Punjab (1,273), Maharashtra (1,210), Karnataka (1,175) and Tamil Nadu (1,043). The report also mentioned that unwarranted compliances are specifically heavy on MSMEs and an average Indian MSME, having above 150 employees, encounters 500 to 900 compliances that cost Rs 12 to 18 lakh annually. Further, it stated that such governing strain influences were not just for businessmen running for profits, but also not-for-profit entities. There is an increasing gap between the goods and services the country needs and how the State views the businessmen generating them.

The report provides a few policy recommendations for change to lawmakers and the judiciary, which the executive, regulators and officials can implement. These include:

- Reform the way policies are designed

- Use criminal penalties in business laws with extreme restraint

- Constitute a regulatory impact assessment committee within the Law Commission of India

- Involve all independent economic regulators in compliance reforms

- End the criminalisation of all compliance procedures

- Create alternative mechanisms and frameworks

- Define standards for legal drafting

- Introduce sunset clauses

- Reform with one legislation and infuse dignity to entrepreneurs, businesspersons and wealth creators.

Also Read: Whatsapp Admin not responsible for objectionable content by group member: Kerala High Court

Unfortunately, governing sickness has drastically reduced the immunity of doing business in India. Legislatures, regulations and policies passed by the Union and state governments have over time generated barricades to the efficient movement of ideas, establishment, money and entrepreneurship and through them, the creation of employment, wealth, and gross domestic product.

Since Independence, unfriendly clauses in business laws and rules have grown drastically, outliving three decades of economic reforms introduced in 1991. The major threat comes from the continuation of confinement as an instrument of control. As automation increases, pre-Independence 1940s-style managerial controls meant to safeguard labour will prove counter-productive in 21st-century India.

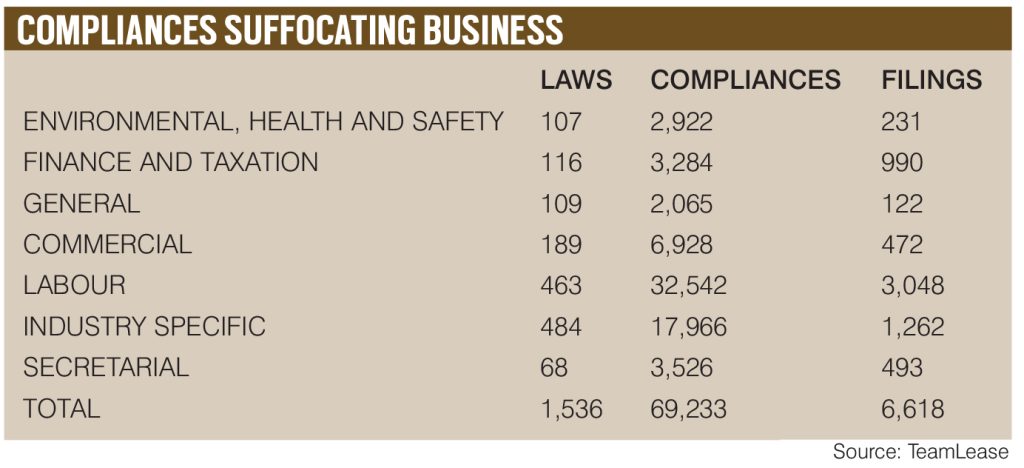

In India, there are 1,536 laws to regulate doing business, of which 678 are executed at the Union level. More than 50% of these laws prescribe imprisonment clauses. These laws have 69,233 compliances, of which 25,537 are at the Union level. These compliances should be revealed to the governments via 6,618 annual filings, 2,282 at the Union level and 4,336 at the state level. These deviations in compliance conditions happen regularly and contribute to business uncertainty. In the 12 months up to December 31, 2021, there have been 3,577 supervisory changes and over the three years from January 1, 2019 to December 31, 2021, there were 11,043 changes in compliance conditions. This turns to an average of 10 supervisory changes every single day.

Also Read: Emasculated Tribunals

More than half the clauses demanding imprisonment prescribe a sentence of at least one year. Many criminalise procedure breaches while a few of them penalise unintentional or negligible lapses rather than deliberate deeds to cause damage, defraud or evade. For some laws, delayed or incorrect filing of a compliance report is an offense whose punishment stands on a par with sedition under the Indian Penal Code, 1860. With over 50 such clauses per law, the highest number of imprisonment clauses are found in labour laws. Thus, criminalisation of business regulations disturbed Indian business from the Mahabharata to the Arthashastra; misconduct was never a part of disciplinary action against businesses in ancient India only financial penalties were.

India’s business regulation demands a 21st-century rethink. A drop in governing compliance has the potential to become the new driver of economic development. This will particularly aid small firms that account for over 95% of Indian businesses. The government should aim to lessen their pain on a priority basis.

Also Read: The Yogi & His Moves

The government should design a master document citing all compliance obligations for each product or service. At present, no listing of all the governing requirements is accessible in one place. Each agency enumerates its prerequisites distinctly. The businessman is at the mercy of mediators. A master document with particulars like regulations, the organization to approach, service charges, probable time of service delivery and a broad perception of the industry will make the business transparent.

A single window system should be established which informs a citizen about which all government departments to contact for completion of a job. For example, making a simple warehouse in India takes approximately six months and much running around. A single window system will reduce time significantly and encourage more persons to enter business.

The language of all legal manuscripts should be simplified. This will erase discretionary powers, decrease lawsuits and allow for online execution of schemes. Several nations have embraced inventive methods for doing this mega task. For instance, in the US, a consulting firm applying text mining techniques examined the US Code of Federal Regulations and found nearly 18,000 sections with text similar to text in other sections. Such techniques should be employed to identify and discard overlapping rules and regulations.

Information and technology have to be utilised to develop regulatory results. Many nations use artificial intelligence and industry 4.0 know-how for boosting service delivery. Their banks and land registrars use blockchain technology to confirm the reliability of each transaction. New Zealand is implanting sensors in buildings to record strain during an earthquake. Such data can also help in providing clearance to a new building or predicting old buildings’ remaining life.

Also Read: Father of 16-year-old girl raped and murdered in Uttar Pradesh moves Supreme Court

Mutual recognition agreements (MRAs) with significant trading associates have to be entered into. This will promote foreign trade and goods and services. For example, an MRA between India and the EU in medicines will inspire two-way business. It will permit EU drug examiners to accept review reports drafted in India vide Indian processes. India will offer similar therapy to drugs from EU nations. MRAs, thus, make national laws suitable to nations with diverse laws.

Prime Minister Narendra Modi wants India’s national ranking in World Bank’s Ease of Doing Business Index to be under 50; presently it is 63. To realise this dream, the government should adopt powerful practices to increase productivity, encourage growth and make India a better place to do business in. Politics must become more accountable to the economy, and political actors must guarantee that the spirit or intent of the law is not hampered by the indiscriminate imposition of imprisonment clauses on businesses. If India’s business environment is to acquire greater competitiveness, compliances must be made less hostile. Or else, India cannot become a $10-trillion economy by 2032.

—The writer is a financial and tax specialist, author and public speaker based in Margao, Goa