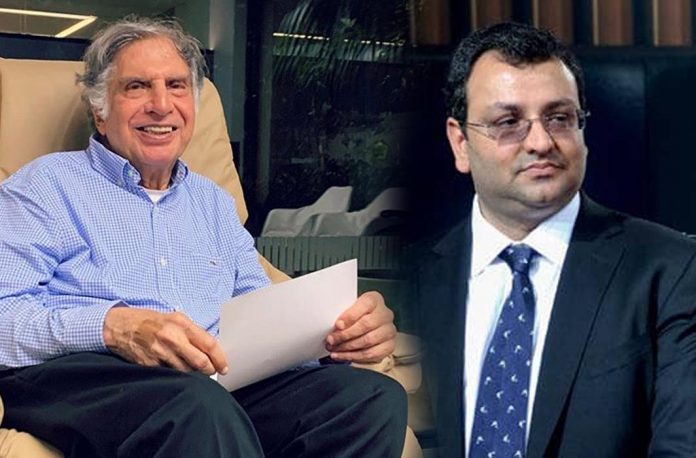

Shapoorji Pallonji’s decision to pledge the Tata Sons’ shares held by them may finally see a permanent shift between the two corporate entities and families. The Tatas may rule through nationalistic fervour, while the Ratan Tata-Cyrus Mistry spat may cost the SP Group dear.

By Sujit Bhar

Tata Sons has put a spanner in Cyrus Mistry’s attempt to pledge some Tata shares to raise money to urgently repay some outstanding debt. Mistry is a prominent holder of Tata stocks through his family company Shapoorji Pallonji (SP). On Tuesday, September 22, the Supreme Court granted a status quo on the proposed pledge and the issue will come up again for hearing on September 28.

Technically, a shareholder can pledge the shares he holds of a company to raise debt. Despite Mistry being of Irish nationality, he is legally allowed to pledge shares of the Indian company. This has been made possible by the Reserve Bank of India’s Circular 57 which permitted non-resident shareholders of Indian companies to

avail loans from Indian and overseas banks using their shareholding in Indian companies as collateral, subject to procuring the no-objection certificate (NOC) from the relevant authorised dealers (AD)

So, Mistry holds that he was on solid legal ground while trying to pledge the shares.

However, the scar from the long-standing Ratan Tata-Mistry spat has not healed and the Tatas stepped in quickly to stop this transaction. When the Pallonji Group had an agreement with Canada based Brookfield to raise Rs 3,750 crore by pledging Tata Sons’ shares, Tata Sons came out guns blazing to stop it. They have hardly forgotten the massive spat that had ensued when Ratan Tata had stepped down to anoint Mistry as chairman of the group. When Mistry wanted to change the very vision of the group, he was forced out. The spat has grown since.

The transaction process (of the proposed pledge) itself has been questioned by the Tatas, saying this was akin to transfer of property. The judge rightly asked how this was transfer of property when it was more akin to a lien, which means it comes back on repayment of the loan. The bench observed that a pledge is a “limited, restricted transfer.”

Senior Advocate Harish Salve, arguing for Tata Sons, said that this objection was because of his “mischief”. He said “in four weeks, situation may be beyond repair if Mistry is not stopped.” He also offered an alternative. He said the Tata group was ready to buy “our shares from Shapoorji Pallonji Group.” The Supreme Court bench then ordered a status quo on transfer, pledging of Tata Sons’ shares by the SP Group.

What was the Tata group’s objection about? As per arguments in the top court, it was clear that the Tata group is scared that its shares may be picked up by outside investors in the event of a default by the SP Group on Tata shares pledged with a bank or NBFC. That takes the entire issue out of the parent company’s control. The other angle and corporate fear to consider would be that this pledge could take the overall percentage of pledged shares of the group to near dangerous levels.

A Reserve Bank of India (RBI) Financial Stability Report had raised concerns over the pledging of shares. It said this could be a case for concern for stakeholders, including retail investors. Shareholders are always wary of a company which has a high level of pledged shares.

A healthy company would not generally require pledging of shares. However, when the overall health of a company falters, this is one of the last avenues of recovery for the company.

Hence, pledging not only adds huge debt to the company’s books, it also reflects the overall health of the company. The Tata group’s pledging record has been good, but if Mistry pledges Tata shares held by him, then it will show up in bad light for the Tatas.

That was one reason why counsel opposed the pledging proposal in court. The other reason was that any major buyer of the shares the name of Warren Buffet and his Berkshire Hathaway investment firm was touted in Court could, theoretically, start a predatory process which, in the long run, could dispossess the promoters themselves of the company they built while also making it non-Indian. The Tatas’ experience with the late Russi Mody as Chairman of Tata Steel (then Tata Iron and Steel Co) is also quite fresh in memory.

Technically, the RBI is not too happy about the pledging of shares by promoters. In its Financial Stability Report, the RBI says that of the over 5,000 listed companies, promoters of 4,274 companies had pledged all or some of their shares, according to an analysis by Securities and Exchange Board of India. That is a huge percentage.

In case of default, not only do the promoters lose their shirts, but all stakeholders could be staring at major losses through loss of public confidence. In this pandemic situation, with stock markets around the world in a rather volatile state, any major shift in stock prices of a company or group of companies could result in a commensurate shift in the indices that draw from such pricing.

Those are the basics of the case in question, but the issue at hand is somewhat larger than that. In the Tata group, there is a nationalistic angle that draws investor confidence. In the current atmosphere of China boycotts, such mega conglomerates, especially of Indian stock, gain credibility. The Tata group is a salt-to-steel conglomerate, with massive market capitalisation and an even bigger public perception. The Tata brand was the virtual face of India, much before the Ambanis arrived. The group is also revered by investors, large and small.

The overall scenario does not seem to fare well for Mistry. It also presents a great opportunity for the Tatas to gain a better foothold within their own conglomerate. When their huge investments abroad in Steel (Corus) and automobiles (Jaguar Land Rover) are facing headwinds amid this pandemic with industrial activity and sales having plummeted, it would be a massive outgo of funds, needed for other urgent matters, to buy out Mistry’s shares. But this effort at buyback will not lack investor support, for sure.

The SP Group is also an old and respected business house in India. It has operations across India and in other countries. Cyrus’ father had been a quiet investor in the Tatas for long. But his son’s ouster has possibly touched a nerve in the grand old man and the SP Group has now said that it is time to part ways with the Tatas.

In the end, if the sale goes through, there could even be a round of applause for a deal well concluded and nationalist pride preserved.