Parking money in Zurich may have become difficult but account holders have already found new ways to beat the system

The illegal transfer of funds to destinations abroad has undergone a sea change in the last five years. Using the traditional and simplistic hawala route where hard cash paid in India was deposited in secret Swiss bank accounts for a cut by the mafia is passe today, at least for the big players. Sophistication is the name of the game. And that was deemed necessary ever since the Organisation for Economic Cooperation and Development (OECD) threatened in 2013 to evolve a Common Reporting Standard (CRS) for the automatic exchange of tax and financial information at the global level to combat tax evasion.

The CRS took shape in 2014 and the Multilateral Competent Authority Agreement has so far been signed by 83 countries, including India. On June 16, 2017, Switzerland ratified the automatic exchange of financial account information protocol with India and 40 other countries. The information flow under it was expected to begin in 2018 but, according to the revised plan revealed by the Swiss government, this will only happen from 2019.

SHARING INFORMATION

On paper, this will seemingly expose those who park their black money in Zurich. But, according to a source in the revenue intelligence, there are enough loopholes for existing account holders to exploit. The agreement is explicit that the past record of an account will not be revealed. “In effect, the status of accounts of Indian citizens as of 2018-2019, when the agreement becomes operational, is what we will get. In the meanwhile, accounts can be depleted to have a balance of a few hundred dollars. The rest can be transferred to tax havens and routed back to proxy accounts in Switzerland operated by non-Indian citizens,” he says.

Indians who have taken up citizenship in tax havens will be out of the purview of the protocol. Two issues ago (July 24, 2017), India Legal had reported how the promoter of Winsome Dia-monds and Jewellery Ltd, Jatin Mehta and his wife Sonia gave up their Indian citizenship and acquired a St Kitts and Nevis passport. India does not have an extradition treaty with this Caribbean island-nation. So, the Mehtas are free to operate abroad, although Winsome Diamonds owes Indian banks Rs 7,000 crore and is the highest willful defaulter after Vijay Mallya.

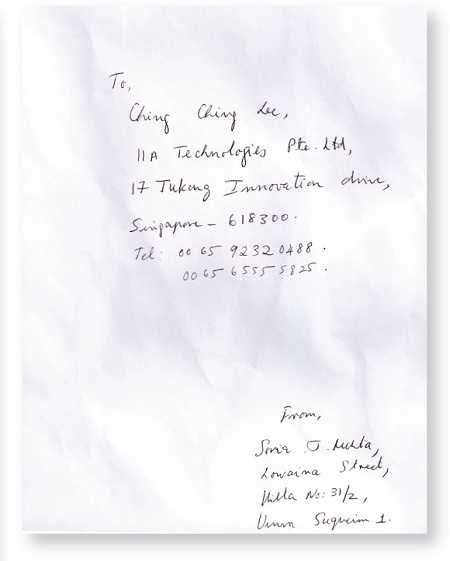

India Legal also accessed a document that confirms that Sonia Mehta has a Swiss account. On June 28, 2017, Sonia Jatin Mehta applied for a bank to bank telegraphic transfer of 398,603.85 Singapore dollars (SGD) worth approximately Rs 1.86 crore from her Far Eastern Bank Account No: 4333 666 744 in Singapore to an account in Bank Vontobel AG Gotthardstrasse 43, Zurich, Switzerland (SWIFT CODE: VONTCH22-XXX). She gave her Singapore address as 33, Jalan Mutiara, Singapore-249208.

We are now publishing the full set of bank documents which should clear all doubts about the existence of Sonia Mehta’s Swiss account and that money was actually transferred. As a citizen of St Kitts and Nevis, she is entitled to open an account in Zurich, although details of the account will not be forthcoming from the Swiss authorities as she is not an Indian citizen.

According to revenue intelligence sources, accounts of non-Indian citizens will be in great dem-and once the information-sharing protocol with Switzerland kicks in. “Getting information could get tricky since it will be difficult to tap into the account of a foreign citizen unless proof is provided that money from India had actually moved there,” says an official. The paper trail, a dreaded term among investigators, is not easy to establish.

According to him, the movement of black money from India may not be easy to track since it could go through a labyrinth of shell companies located in India and abroad. Some of these may be operated in the name of foreign nationals and the movement could be masked as import-export. “Establishing the Indian angle will become even more important in the days to come because money will not be stashed away in the name of a wife, brother or a business associate as was done in the past,” he says.

GREAT DEMAND

But why this preference for a Swiss account? It is traditionally known to be safe and money from an account in Zurich can be readily accessed or transferred quickly anywhere in the world. It is Swiss efficiency that works, although banking operations in several countries like Dubai and Singapore are equally secretive and efficient.

Though there is a taint of black money in popular perception, there is nothing illegal about an Indian citizen opening a Swiss account. Any individual above the age of 18 can do so, although the bank can reject an applicant if his or her antecedents appear suspicious.

The most coveted account in Zurich is the secret one or the numbered account. All interaction with such an account is through the account number. But for accounting firms sworn to secrecy, very few in the bank know the identity of the account holder. Such an account can be opened only after a personal meeting with a bank representative and a minimum deposit of $1,00, 000.

Despite all the international agreements signed, getting information from the Swiss banking system is not easy. Reason: the USP of these banks is secrecy and the more information that is shared, the less popular they become. . Banks and security dealers in Switzerland number between 350-400 and are worth 32 billion Swiss Francs and represent 5.12 percent of the country’s GDP. It is in Switzerland’s interest that the banking system is kept opaque from investigators. This is why many probes fail to make any headway once the trail leads to accounts in Zurich.

—By India Legal Bureau

Related stories :- The Winsome Swiss Account , Wilful Defaulters: The Rise and Fall