Above: Many people think GST is good in theory but will be chaotic in practice

Is the new tax regime introduced by the government a big bang reform similar to the one introduced by the Congress in 1991? Or will it take the shine off Modi’s biggest economic initiative since he took office?

~By Parsa Venkateshwar Rao Jr

For a party that has had a love-hate relationship with economic reforms, the Goods and Services Tax (GST) initiative is indeed a radical move of the BJP. And the Modi government is staking its political reputation in rolling it out successfully. That it opposed the GST when it was in opposition from 2004 to 2014 is now seen as an embarrassing detail and nothing more. Will GST steal the thunder from the Congress which ushered in reforms in 1991? That waits to be seen.

But despite Prime Minister Narendra Modi tilting towards welfare measures and economic populism resembling that of the Congress and GST being hailed as a revolutionary measure, the government knows that implementing it will be a tough challenge. When Finance Minister Arun Jaitley interacted with the media on June 1, he said with a deadpan expression: “I see no reason for the adverse impact of GST.” But he and the bureaucrats in his ministry know there will be glitches aplenty as it gets implemented.

Though Arvind Virmani, former Chief Economic Advisor between 2007 and 2009 termed GST as “the single most important economic, constitutional change since Independence,” Arvind Singhal, chairman, Technopak Advisors, felt that the multiple tax zone system would be untenable and had to be changed. He said there would be problems in implementation and it would take six months to a year for things to settle down.

Chartered accountant Raman Khatua said: “Tax laws have been simplified but the ease of doing business has been made more difficult than before because of compliance procedures.” This is the reality of GST despite the website of the Central Board of Excise and Customs, the GST administrator, claiming that GST will “maximise economic gain & minimise compliance pain”.

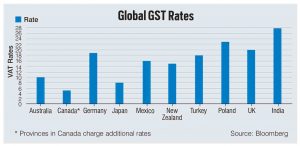

GST rates

At the GST Council meeting on May 1 at Srinagar, a list of goods under the different rates—5, 12, 18 and 28 percent—was finalised but not completed. For example, textile, footwear, bidis and precious metals are yet to be fitted into categories. Even on those items slotted under one rate, further vetting and change will take place. But the present list is formidable yet simple compared to the older system which had hundreds of separate categories. The present list is confined to 96 chapters in the GST rate manual, with four categories for each item, starting from nil tax and peaking to 28 percent.

Chapter 1 deals with Live Animals. The nil tax category is for all goods other than live horses, asses, mules, hinnies, bovine animals, swi-ne, sheep and goats, poultry, mammals, birds and insects. Live horses fall in the 12 percent GST rate.

Chapter 2 deals with meat and edible meat offal. In the nil rate category fall fresh and chilled meat of bovine animals, swine, sheep and goats, horses, asses, mules or hinnies, edible offal of bovine animals swine, sheep, goats, horses, asses, mules or hinnies, poultry. But all meat “in frozen state and put in unit containers,” meat and edible meat offal “salted, in brine, dried, or smoked” attract 12 percent GST.

Chapter 3 deals with fish. Here, all fish “processed, cured and in frozen state” attracts 5 per cent GST. Chapter 4 is about dairy produce and eggs. Fresh eggs, curd, lassi, chenna and paneer fall in the nil category, ghee, butter oil, cheese have been slotted in the 12 percent rate slab and condensed milk attracts 18 percent GST rate.

Chapter 97 dealing with works of art, collectors’ piece and antiques has the single rate of 12 percent. However, there will be changes, though it is difficult to say what kind.

Small businesses in the manufacturing sector will bear most of the brunt of GST implementation. Under existing excise laws, only manufacturing business with a turnover of more than Rs 1.50 crore have to pay excise duty. However, under GST, the turnover limit has been reduced to Rs 20 lakh, thus increasing the tax burden for many manufacturing SMEs.

Khatua gave two examples of the hurdles ahead. For example, if a person buys tea for Rs 10 from a street-vendor, he is expected to state the name of the vendor and keep a receipt. In the second case, if a customer is purchasing from an unregistered person, he will have to pay GST for the transaction. He said that every transaction would be taxed and talk of exemptions was a mere eyewash and even false.

He also foresaw a clash between excise authorities and businessmen in the interpretation of GST rules and various tax slabs. For example, would a particular item fall in the slab of 12 per-cent rate or 18 percent? He feared that excise authorities would want to place more items in the 18 percent slab. So, expect more tax litigation under the GST regime. Though a list of items under each slab would help in averting confusion, he said the old quarrel between the taxman and the businessman would continue.

Hiccups would crop up in the immediate aftermath of GST rolling out on July 1. One would be businesses holding old stock and selling it under the new tax regime. Also, tax collections might fall in the second quarter of the 2017 financial year. It also waits to be seen whether tax rationalisation benefits promised by GST would be passed on to the consumer. However, the anti-profiteering clause in GST would serve as a deterrent, said Khatua.

A spokesperson of a national trade and industry body speaking on condition of anonymity said the transition period would be painful. Though industry organisations had been clamouring for GST for decades, he said it would be difficult for them to now complain about the pain in implementation. So would GST be a bitter pill that industry and businesses would have to swallow? He admits that business people, especially small entrepreneurs, were not in the habit of maintaining records and filing monthly returns and they would have to get used to doing so soon.

Congress general secretary and party spokesperson Manish Tiwari cryptically said that GST’s impact would have to be seen in the weeks and months ahead, and no amount of celebrity endorsements—a dig at Amitabh Bachchan’s audio-visual clip run by the government media—would help.

Congress general secretary and party spokesperson Manish Tiwari cryptically said that GST’s impact would have to be seen in the weeks and months ahead, and no amount of celebrity endorsements—a dig at Amitabh Bachchan’s audio-visual clip run by the government media—would help.

Tiwari recalled former Prime Minister Manmohan Singh’s January 2011 statement saying that the BJP wanted criminal cases against some of its leaders withdrawn in return for support for GST, indirectly saying that this move was the Congress’ idea and that the BJP was walking away with the laurels. While earlier the BJP was against GST, it was now the turn of the Congress to adopt a lukewarm stance towards its own “baby”.

Pitfalls of GST

Increase in Operating Costs: Most small businesses do not employ professionals and prefer to pay taxes and file IT returns on their own. As GST is a new tax system, they will require professional assistance and have to bear additional cost.

Change in Business Software: Most businesses use accounting software or ERPs for filing tax returns which have excise, VAT, and service tax already incorporated in them. The change to GST will require them to change their ERPs, too, leading to increased costs of purchasing new software and training employees.

More Confusion: GST implementation date is July 1, 2017. So, for fiscal year 2017-18 business will follow the old tax structure for the first three months, and GST for the rest of the year. Businesses will end up running both tax systems, resulting in more confusion and compliance issues.

Increased Tax Burden: GST has only four proposed tax rates. Thus, for many sectors, the tax burden will increase, which in turn will increase the price of the final goods.

Petroleum Products: These have been kept outside the scope of GST as of now. States will levy their own taxes. Tax credit for inputs will therefore not be available to related industries like the plastic industry and factory machinery, pushing up the final price of all manufactured goods.

Registration in Multiple States: GST requires businesses to register in all the states they are operating in. This will increase the burden of compliances.

E-commerce: Many SMEs operate through their own online shopping websites or through third party websites. Under GST, they will be required to register in all states.

No anti-inflationary Measures: Every country experienced a hike in inflation when they first introduced GST. This was countered by keeping tabs on prices and anti-profiteering measures at the retail level. But India does not have concrete anti-inflationary measures in this regard.

Meanwhile, in an open letter, Bharat Goenka, MD of Tally Solutions Pvt Ltd, pointed out that one major lacuna of GST would be the transference of responsibility and liability of tax remittance to the customers. If a particular supplier failed to comply with the law by furnishing correct returns, then its customers cannot avail the input credit, and if given, it would be reversed. “The problem is not the ‘management of a manifest risk’—the problem is the side-effects of cash flow, improper accounting, and reduced ability for people to trade with new suppliers and new customers—since there is uncertainty about the business outcome,” he said.

“With the framing of this law, the Government hopes that the market will self-weed out the bad eggs—the process of which is not wrong in theory. What is wrong is not in understanding the cascading consequences of doing this in practice—and the mayhem it will create. While the effort for driving compliance will reduce, the consequential effect of businesses shutting down, and therefore collections going down, have not been treated seriously enough,” he added.

GST has been implemented after traversing through a long and winding road and paved with political rivalries and electoral fortunes. In 1991, when the Congress ushered in liberalisation, many in the BJP who prided them-selves as anti-socialists, hated state interference in economic affairs. There were some like LK Advani who opposed economic reforms and gave tacit support to rabid anti-market forums like the Swadeshi Jagran Manch and opposed India joining the World Trade Organisation. Vajpayee maintained a discreet silence on the issue. When the BJP led a coalition government from 1998 to 2004, Vajpayee pushed for market reforms and set up the Kelkar Committee to look into tax reforms. But it could not be taken to the next level because the BJP lost the election in 2004.

In the decade from 2004 to 2014, the BJP opposition again felt left out when Prime Minister Manmohan Singh tried to push for reforms. Being the main opposition party, the BJP opposed the few economic reforms that the Singh government was able to push through. At the same time, the BJP targeted Congress president Sonia Gandhi and the civil society-dominated National Advisory Council in pushing through welfare measures like the Food Security Act.

Finally, the Modi government has brought GST to fruition.