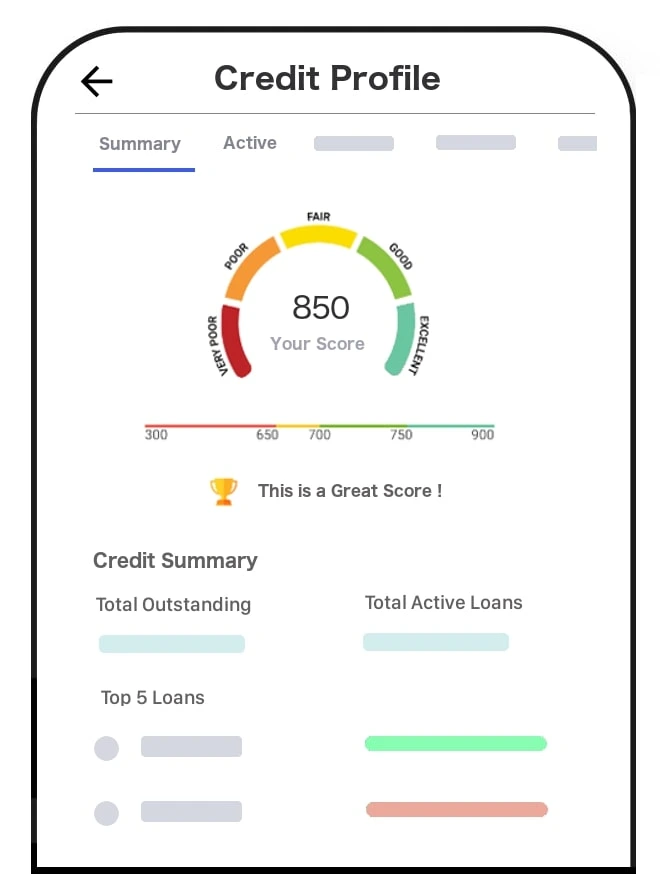

Just like our everyday habits shape different aspects of our lives, our financial habits help build our credit profile and shape how we stand in the credit landscape. Your credit journey starts the moment you take a loan or start using a credit card, creating a credit footprint that shapes your credit score—a three-digit numeric summary of your credit report (ranging between 300–900), that reflects your credit behaviour and habits over time.

Good credit habits lead to a strong credit profile and a high credit score, whereas poor habits do the opposite. Lenders rely on your credit score to assess your creditworthiness (repayment habits and behaviour patterns) before approving loans or credit cards. That is why building and maintaining good credit habits becomes all the more essential. You should check CIBIL score, the credit score provided by TransUnion CIBIL, from time to time to assess your creditworthiness and try to maintain this score as close to 900 as possible.

If you are not sure about where to start? The following are a few key credit habits that can help you build and maintain a positive credit profile:

- Planning your Financial Goals and Priorities: When accessing credit, it is important to keep your priorities and financial goals in mind and weigh your credit options carefully, too. You should consider your income to EMI ratio (that is, how much of your monthly income goes towards EMIs and credit card payments) and try to keep it low. Moreover, apply for fresh credit only when you need it. This kind of planning may help you achieve your financial goals and maintain a positive credit profile.

- Save and Budget: Save up for a rainy day and budget your monthly expenses, upcoming expenses, loan obligations, as well as, repayments. Even though we live in an age where credit is available with the touch of a few buttons, it is advisable to save up for unforeseen emergency expenses or financial hardship. It is good to set aside a particular amount monthly towards this emergency fund. The rule of thumb is to have about three months’ of salary stashed away as an emergency fund, so that you can sail through the difficulty with a bit of ease.

- Keep a Watch on your Expenses: Keeping a tab on your earnings and monthly or weekly spends (also known as your income to expense ratio) can help you track your expenditure, understand the avoidable and necessary expenses and manage your expenses better. Try and maintain a diary, meticulous Excel files and programs or just go for a personal finance tool that can help you track your expenses better.

- Use Credit Judiciously: Even if you can access credit easily and it may help you achieve your life goals or support you in case of emergencies, it is advisable to be judicious about the frequency with which you may apply for loans or credit cards. Moreover, making too many credit enquiries may show you to be credit hungry and decrease your creditworthiness. Also, even if you have a credit card with an extended credit limit, it is advisable to maintain a low credit utilization ratio and spend well within your card limit. Maxing out your credit cards will not only increase your credit burden but may also impact your repayment capability at a later stage.

- Be Credit Conscious: Just like you keep a track of your finances by checking your bank statements and investments regularly, it is also recommended that you monitor your CIBIL score and report regularly. This can help you have a clear picture of your credit profile, credit card spends, loan amounts and credit behaviour, while monitoring the credit information shared by your lenders and banks with the credit bureaus. It can also help you have a better understanding of your credit eligibility, so that you can get access to credit when you need it the most.

Keep in mind that you cannot develop all of these habits overnight. However, you can slowly but surely work towards building up good credit habits and a healthy credit profile, which can eventually have a positive impact on other aspects of your life too.