By Sujit Bhar

There have been two very damaging after effects of the sordid affair involving Gautam Adani and his shady empire, as exposed by US “short-seller” Hindenburg Research and through the equally shady withdrawal of the apparently “oversubscribed” Rs 20,000 Follow-on Public Offering (FPO) of Adani Enterprises. The first was that a somewhat decent Union Budget’s sheen has been almost fully buffed out and secondly, and more disastrously, India’s position as a dependable financial giant before the world has been tarnished like never before.

This is not just a shameful episode in Indian corporate governance, but, considering the open closeness of Adani to the powers that be, it might translate to national embarrassment. This could lead to the immediate flight of foreign capital at the minimum, to a loss of long-term foreign investment, even with India bonds being downgraded in international markets. The unfolding of the acts of a single unscrupulous mind has the potential to derail the entire development and political process of the country.

Also read: Adani unites Opposition

In a year in which nine state elections are lined up, and racing into next year’s general elections, neither the government nor the Securities and Exchange Board of India (SEBI) can afford to be near the toxic influence of the Adanis. As of writing this, the Nifty index still had Adani Enterprises and Adani Ports and Special Economic Zone affecting its position. And this remains, even as, in the US markets Adani Enterprises (XBOM: 512599) shares face removal from the Dow Jones Sustainability Indices, effective prior to opening on February 7, 2023.

That will not only be egg in the face of the Indian market regulator, which allows the presence of these toxic stocks on the index, but will raise questions about what the ulterior motive of the silent SEBI is, when Adani’s empire has lost market cap of around $120 billion, plummeting the man from a temporary perch as the world’s second richest man to 17th with a net worth of $ 61.9 billion.

The Opposition parties are up in arms and the Budget Session in Parliament was completely disrupted with calls for a discussion on the Adani affair and for a Joint Parliamentary Committee to investigate it. The day’s Speaker, Rajendra Agarwal, did not allow this discussion to take place and Lok Sabha was adjourned to February 6. In the end, strangely, one errant corporate giant seems to have brought about an Opposition unity of sorts.

What Hindenburg did

What Hindenburg Research had done (on January 24) was disclose a short position against Adani Group’s listed companies, while publishing a report that accused Adani of engaging in a “brazen stock manipulation and accounting fraud scheme over the course of decades”. What Hindenburg has done, against all criticism, is not illegal.

It came as a shock, and the FPO was caught in the middle. Adani wanted to pay back debts with this FPO, but the markets responded to the Hindenburg report with a bloodbath of Adani stocks. Sell orders were everywhere, across all Adani companies, including its flagship Adani Enterprises. The first day of the FPO saw just 1% subscription, climbing to 3% the day after. It was clear that the FPO wouldn’t go through. Meanwhile, the stock price had already slumped way below the FPO price band.

Also read: Some of Hindenburg’s questions to Adani

What really broke the camel’s back was an announcement by Credit Suisse that it would no more accept Adani bonds as collateral for loans. Other international bankers followed suit. That created panic in the market.

Late into that night of February 1 (Wednesday), as Adani announced that he was withdrawing the just-completed FPO, one was sure of complete disaster the day after. Most stocks of the Adani Group hit the lower circuit breaker immediately after Thursday’s market opening.

Today, Adani is a name that no investor worth his salt would want to touch, not even with a 9-foot bargepole. The entire report of US short-seller Hindenburg Research is slowly, but steadily being digested and being treated as believable. That is a slap on Indian corporate governance norms, as Enron and the sub-prime scams were on American norms.

The Hindenburg Research report called the accounting practices of the group a “con” job. The interesting part of the entire slip in Adani’s fortunes is that the tsunami of sell orders was created within a small percentage of Adani stocks (different companies). Around 70% or more of the stock of most Adani companies are promoter held, with another 10-15% (sometimes more) held by institutional investors.

The market always knew

That this sell-tsunami happened in such shallow, free float waters brings to light one thing—the market always knew the many underhand and unscrupulous dealings of Adani and the group in general. The Hindenburg report was the trigger that let loose the massive landslide. The market feels that the umbrella of political protection that Adani had got so far, may now be removed. This also shows that sentiment, more than any logical thinking, governs the markets. That is also the factor which enabled Adani to ramp up the price of his shares in such a short time.

More than the Hindenburg report, the shady accounting practices of the group (domestically) is common knowledge in the market, but none dared to open his mouth, fearing powerful reprisal. The super leveraged debt position of the group was open for all to see, all the time.

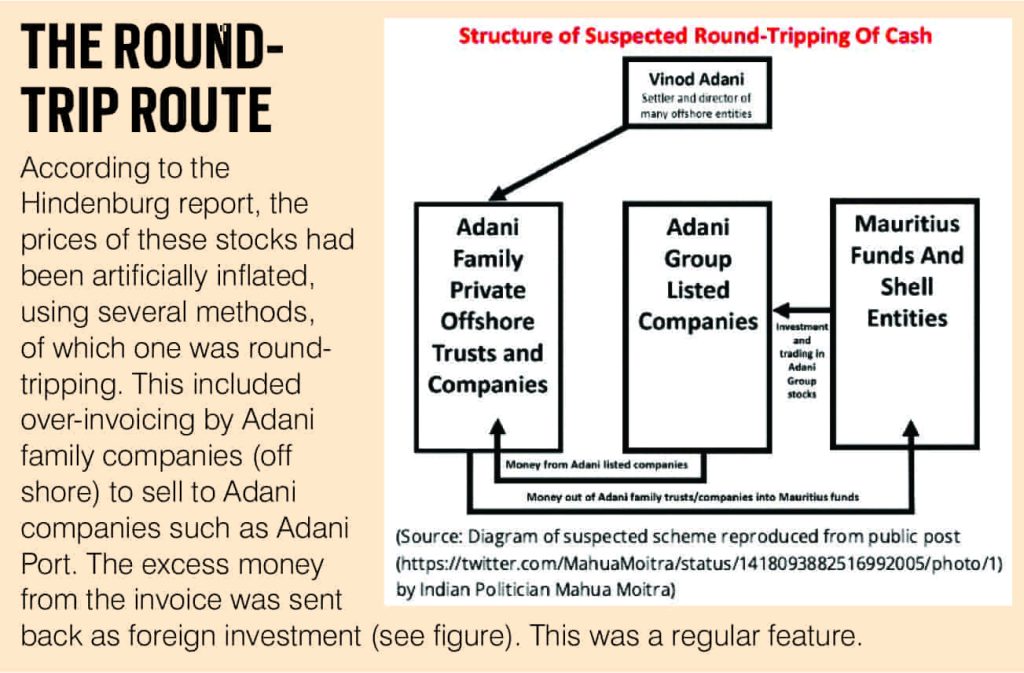

What the “short-seller” report brought out into the open was certain shady international cross-holdings within the group and how monies were round-tripped to boost the share price and hence the apparent wealth of the group. The entire process was also ripe for money laundering, a serious crime in this country.

One must point out as a caveat that most of the companies of the group (except Adani Enterprises), on their own, are operationally sound. Had they not been super-leveraged through debt, the companies could have organically grown, though the extent of valuation growth that has been evident was, obviously, with steroids of political patronage.

The interesting part of this entire issue is that no Adani company figures among the top 15 tax paying corporate entities in India. For the common man, this piece of information is mystifying and there seems to be some sense in reading through Hindenburg’s report, titled: Adani Group: How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History.

The full FPO subscription itself seems to have been another story of a late manufactured diversionary act.

In his announcement withdrawing the FPO, Adani said he was withdrawing on moral grounds and to protect his investors. This moral high ground theory looks very specious. Forbes leaked a report that it is possible that Adani bought into his own shares in the $ 2.4 billion FPO to make it look successful. Hence, it may be that the entire intention of carrying on with the FPO on the blood-soaked Dalal Street was to create a mist before retail investors, saying foreign investors and HNIs still had Adani’s trust. The SEBI needs to investigate this as well.

Memories of Enron

Let us move back a few years to a massive scandal that had rocked the US. This is the story of Enron Corp. once one of the largest corporate entities of America. Not only did thousands lose their jobs, the entire US financial system was put in doubt. When Enron was at its peak, its shares were worth $90.75. As it declared bankruptcy on December 2, 2001, the shares were trading at $0.26.

What happened? The basic con was the company fooling regulators with fake holdings and off-the-books accounting practices. While Enron used special purpose vehicles (SPVs), or special purpose entities (SPEs) to hide its mountains of debt and toxic assets from investors and creditors, it has been alleged by Hindenburg that Adani uses a web of offshore companies (in the Cayman Islands, Mauritius, etc.), mostly held and/or controlled by Gautam Adani’s elder brother Vinod.

More brazenly, though, the debt leveraging of the Adani companies was not hidden at all. It was for all to see how Adani bought companies with debt, bloated stock prices with further debt as well as with returns of round-tripped over-invoiced monies, and then again increased debt by pledging the now highly priced shares to the same banks from which they took loans in the first place. This, in most cases, was the ubiquitous public sector giant, the State Bank of India, the Indian conman’s favourite whipping boy.

The Hindenburg report has provided a very interesting round-tripping sketch, borrowed from Trinamool Congress MP Mahua Moitra’s presentation.

The Satyam Computers Case

The Satyam Computer Services scandal was India’s largest corporate fraud until 2010. Adani, of course, has taken the cake in this. In that fraud, founder chairman Byrraju Ramalinga Raju and directors of the India-based outsourcing company had brazenly falsified the accounts, inflated the share price, and had siphoned off large sums from the company to invest in property. As, in late 2008, the Hyderabad property market collapsed, money trails led back to Satyam. In 2009 Raju confessed.

While that was big, one thing was clearly missing for Raju: political patronage. Adani has made it clear that, politically, he was on rock solid ground.

The research report

Before going into some details of the research report in which Adani has been asked 88 pointed questions, one needs to wrap one’s head around the overall picture presented by the report in simple terms.

While the Adani-led Adani Group has seven publicly listed companies and 578 subsidiaries, all companies are largely managed by his family members. As the report was being compiled, these companies commanded a market valuation of $200 billion. And to get a picture of how closely controlled are these companies by Adani and his family members (a bit extended too, sometimes), one just needs to note that Adani’s net worth in 2018 was $20 billion. This had shot up to an astronomical $120 billion by 2022. Nobody has ever reached such valuation in such short a time. There had to be something more to it that meets the eye.

Let us consider Adani Enterprises, the overall company, whose FPO was withdrawn within the dirty scent of the scam. As of December 22, 2022, Gautam S. Adani/Shri Rajesh S. Adani (on behalf of S.B. Adani Family Trust) held 55.27% of its shares. Adani Tradeline Private Limited held 8.73%, etc. The total promoter shareholding was at 72.63%, including 8.63% of foreign promoters, which would generally be companies owned or controlled by Vinod Adani, according to the Hindenburg report.

Total institutional holding is at 20.84%, of which LIC, bloated with monies and trust of the hardworking people of India, holds 4.23%. It is being asked why LIC invested in Adani, when everybody knew of its apparently fraudulent practices. Who forced the LIC into this shady investment deal?

When Live Mint asked LIC on January 30 about its investment, LIC had said that, over the years, it invested Rs 30,127 crore in Adani group assets, and as of January 27, the absolute market value of its investment was Rs 56,142 crore. This value has collapsed spectacularly, as have LIC shares. This is public money, and if the mega life insurer suffers bad health, it will directly affect the individual policy holder who has spent decades, slowly saving up for a decent life after retirement.

It was not that LIC had no inclination of this. Adani group companies have had very little investment from mutual funds, controlled by professional fund managers. And LIC fund managers would have been completely aware of this. Mutual fund holdings in Adani shares are at 1.19 % and they have been reducing exposure to Adani stocks over the last few months.

The debt burden

When the bloodbath started, the entire stock valuation of the companies shattered. Say, an Adani share was priced at Rs 100 before the crash, having been boosted to that level (from a face value of Rs 10) through the several methods mentioned earlier. When Adani pledges that stock to the banks, the bank would distribute the loan, assuming it had a Rs 100 asset in its grip. Say the loan through the pledge was Rs 70 at PLR. Now that the share price is reaching Rs 50, or less, how does the company service this?

As is said in India these days, “If you owe the bank Rs 100, it’s your problem. If you owe the bank Rs 100 core, it’s the bank’s problem.” These are massive NPAs in the making.

Adani rebuttal

In its 413-page strong Adani rebuttal to the 88 questions asked by the New York-based “short-seller”, the Adani Group raised questions on the motivation behind the report and said it is case of unethical short selling by a foreign entity by publishing a report to manipulate and depress the price of stock, and create a false market.

It claimed that this was an attack on India (how the group arrived at this conclusion is not clear), but barely could scratch the surface of the allegations. Adani said it will go to court, which was welcomed by Hindenburg, saying that all details would come out in the open, officially, in the discovery process. It is unlikely that the Adani group will have the gall to challenge the small US company in a US court. That is a difficult turf and no amount of political backing will help.

The Fitch report

It is not only Hindenburg that has made such allegations against the Adani Group. In August 2022, American finance and insurance company Fitch Group had warned that the group had taken on too much debt and raised the possibility of a default “in the worst-case scenario”. However, the report also said the Adani Group draws “comfort” from its strong relationships with banks and India’s government. Indeed, the conglomerate has been described as being “too big to fail” for the Indian government.

What foreign media feels

Wall Street Journal columnist Megha Mandavia has noted that the Indian government’s handling of the crisis will shape “foreign investors’ perception of the country’s attractiveness”. “Foreign investors, who hold a large chunk of the conglomerate’s sizable debt, may be reluctant to keep financing it until they are confident that the regulator has thoroughly assessed Hindenburg’s claims,” she argued.

Britain’s Financial Times has described the crisis as a “defining test for India Inc”. In its daily investment column, the newspaper said the relationship between Indian politicians and the business elite “is worryingly close”. However, it argued, “India can dispel negative interpretations of such ties by investigating the Adani affair thoroughly and with extensive public disclosure.”

These are the challenges before the government today. The goodness of the ruling dispensation will depend on what it does with this scandal.

—The author writes on legal, economic and corporate issues, apart from social commentary. He is Executive Editor at India Legal

About Hindenburg

According to its website https://hindenburgresearch.com, this is a small firm founded by Nate Anderson, CFA, CAIA, and says it “specializes in forensic financial research. Our experience in the investment management industry spans decades, with a historical focus on equity, credit, and derivatives analysis.” That would do away with the idea that they are the short-sellers. What they do is tie up with brokers who take short positions on firms which are being “investigated” by the firm and when disparaging details emerge from the accounting practices of the firm and the share prices tank, the short seller(s) profit on delivery.

Hindenburg would be having a commission deal with the short sellers. Though this sounds pretty unethical, it is definitely not illegal. The site (there is no address) says: “In particular we often look for situations where companies may have any combination of:

- Accounting irregularities

- Bad actors in management or key service provider roles

- Undisclosed related-party transactions

- Illegal/unethical business or financial reporting practices

- Undisclosed regulatory, product, or financial issues

And more.

Hindenburg’s claim to fame was how in September 2020 “We released a report titled “Nikola: How to Parlay An Ocean of Lies Into a Partnership With the Largest Auto OEM in America” that, with the help of whistleblowers and former employees, called out a vast array of alleged lies and deceptions by Nikola in the years leading up to its proposed partnership with General Motors.

In 2022 Nikola founder Trevor Milton was convicted by a US jury of fraud in a case alleging he lied to investors about the electric and hydrogen fuel cell company’s technology. That was the fatal blow. Now it’s the turn of Gautam Adani.