By Sanjay Raman Sinha

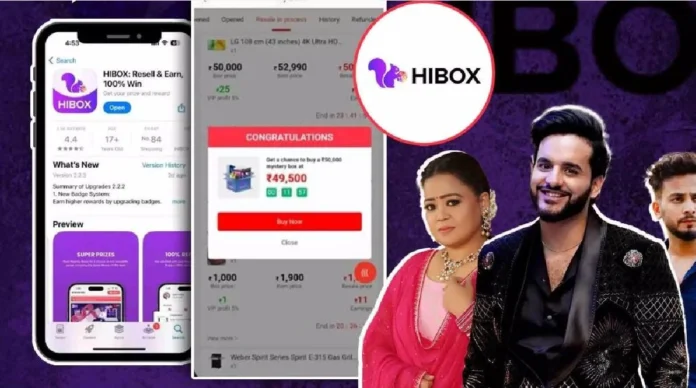

It’s the story of a new-age Jamtara. A digital con that used glamour, trust, and viral reach to dupe over 30,000 unsuspecting investors. At the centre of this sprawling investment scam is the now-defunct Hibox app—promoted by some of India’s top influencers, including Elvish Yadav and Bharti Singh—and a web of deceit that’s now under the scanner of the Enforcement Directorate and Delhi Police’s cybercrime unit.

The Hibox case has ripped open the dark underbelly of influencer marketing, where fame meets fraud, and liability is murky at best.

The Rise and Fall of Hibox

It began in February 2024. The Hibox app hit the market with promises of extraordinary returns—1% to 5% daily and up to 90% monthly. It was classic Ponzi—but with a twist. This time, the bait wasn’t anonymous cold calls or phishing emails. Instead, the company roped in celebrities and viral social media personalities to endorse the app through promotional videos and sponsored content. The result: rapid traction, especially among younger audiences and small-town investors.

Over 30,000 people poured their money in, spurred by trust in familiar online faces and the promise of quick wealth. Initially, returns flowed in, creating a sense of legitimacy. But by July, the cracks showed. Payments stopped. The company vanished. Its Noida office was shuttered overnight.

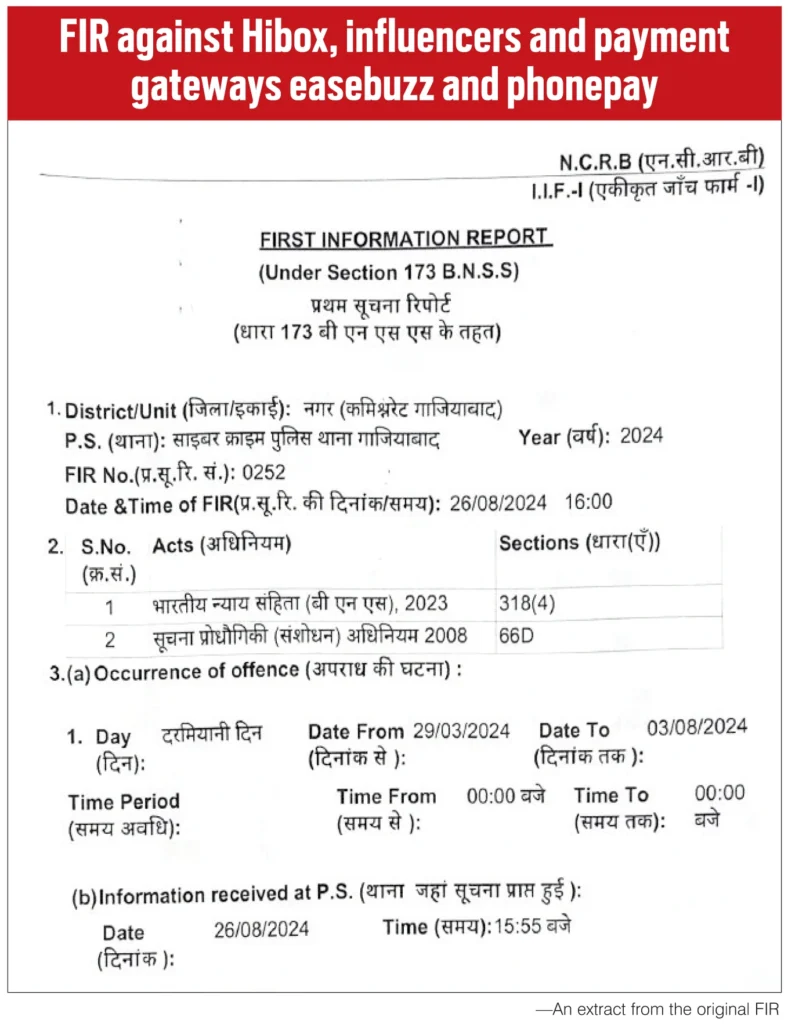

On August 16, 2024, the Delhi Police’s Intelligence Fusion and Strategic Operations (IFSO) unit received the first batch of complaints. Four days later, an FIR was filed. Soon, the trail led to J Sivaram—director of Hibox’s parent company, Sutrulla Express Private Limited. He was arrested, and Rs 18 crore was seized from associated bank accounts. But the focus quickly shifted to those who gave the app its credibility: the influencers.

From Fame To FIRs

Notices were issued to 10 influencers, including Elvish Yadav and Bharti Singh, for allegedly promoting Hibox and luring people into investing. They were called in for questioning by IFSO. Simultaneously, the Patiala House Court began hearing a cheating case filed by scammed investors.

The marketing firm Growing Mafia, which had signed these influencers for promotional contracts, saw its accounts frozen. According to sources, influencers received payments ranging from Rs 10 lakh to over Rs 1 crore per video. While some of these transactions were officially taxed, others are suspected to have bypassed financial systems entirely—possibly through crypto payments like Bitcoin, and funnelled via tax havens such as Dubai.

The Machinery Behind The Con

What emerged was a sophisticated marketing operation with forward and backward linkages to the advertising industry. Influencers were not acting solo—they were strategically organized by Growing Mafia to lend credibility and reach to Hibox through coordinated campaigns.

This incident serves as a case study of how influencer marketing, once an organic offshoot of social media culture, has ballooned into a billion-dollar business with blurred lines between commerce and complicity.

Payment gateways such as Easebuzz and PhonePe were used to process investor funds. These are now under investigation. Authorities say employee involvement at these platforms cannot be ruled out.

The Shifting Landscape Of Liability

Influencer-driven promotion is not new. It evolved from product placements in films to targeted content on YouTube, Instagram, Facebook, and Twitter. With global viewership and sky-high engagement, influencers became the new-age marketing tool. But as visibility grew, so did the risk.

Legal experts now point out that under India’s Consumer Protection Act, 2019, influencers can be held personally liable for endorsing misleading or false claims. Jail terms, hefty fines, and endorsement bans are all on the table for repeat offenses.

And the tax net is catching up too. With influencer earnings skyrocketing, the Income Tax Act now mandates them to maintain books of accounts, file returns, and pay 18% GST if turnover exceeds prescribed limits.

The Big Picture

The Hibox scandal may be just the tip of the iceberg. Investigators believe many such app-based scams may be operating under the radar, using influencers as unwitting—or complicit—tools in their schemes.

As the case proceeds in court and the ED tightens its grip, it’s a wake-up call for digital influencers: quick money from shady deals can come with long-term consequences. The era of casual credibility is over. Due diligence is no longer optional—it’s legal self-defense.