Paytm Payments Bank has been slapped with a central bank order that could see it wither, unless many of the compliances demanded by the bank are immediately met. In the end, other payment portals will benefit

By Sujit Bhar

“PAYTM karo…” may not become history yet, but the bank associated with it is surely in deep trouble, facing cancellation of licence. Paytm, one of the largest and most elaborate UPI Payment gateways of India, had a Reserve Bank of India (RBI) notice slapped on it (also on One97 Communications Ltd, its parent) on January 31, ordering Paytm Payments Bank to stop accepting fresh deposits in its accounts or popular wallets from March this year.

The start-up, which was conceived as a fintech firm in the new Indian business ecosphere, and one which grew to national importance on the back of a painful crisis called demonetisation, has been having its nose rubbed in the ground for quite some time in the past. And today, after the RBI found that the bank has not bothered to adhere to any KYC requirements as per RBI guidelines, putting the entire banking system’s checks and balances in jeopardy, the notice was sent.

One remembers that evening, on November 8, 2016, when Prime Minister Narendra Modi, in an 8pm nationally televised broadcast, declared that Rs 500 and Rs 1,000 currency notes will no longer be valid, creating an ocean of confusion and chaos among the common people. The very next day, Paytm brought out full page print ads in newspapers, with its founder Vijay Shekhar Sharma congratulating the Prime Minister, with a word play on its tagline “Ab ATM nahin, #Paytm karo”. The ad also had the PM’s picture in it.

This not only showed—at least Sharma wanted it to show that way— the proximity of the PM with the organisation, but people were almost sure that when Sharma was able to ideate, design and issue release orders of so many ads in newspapers the very next morning, he surely had an inkling of the pending announcement of the PM long before that fateful November 8 evening.

From that stupendous high, and with his payment module becoming almost a monopoly for some time after demonetisation, to this crash has been a long journey, not much of which has been happy.

In an address to a group of founders of start-ups, Sharma tried to show a brave face, saying: “(The) Indian start-up dream must overcome every situation collectively… We should not let anything deter us from what we all have built over so many years.” Paytm has said it will terminate business with its affiliate (bank) and seek partnership with other banks, but it is easier said than done.

So much bravado, though, seems synthetic in the face of what has happened and how public sentiment has already started going against the company.

Share prices crash

As of writing this—Friday, February 2, post trading hours—the share price of Paytm fell another 20% (it had fallen 20% to hit the day’s lower circuit breaker on Thursday as well) before hitting the lower circuit that temporarily halts trading. Paytm fell to Rs 487 within minutes of the market opening, the lowest it has hit in 55 weeks.

Paytm, which currently has a market cap of $3.73 billion, has lost $2.1 billion in its market cap in two days.

If this trend continues, Paytm shares may reach junk level in a matter of days. That might leave the company in tatters, if the management is not able to pull off some drastic changes and comply with RBI requirements.

The Paytm bank is not exactly like other merchant banks. This is a specialised payments bank, and its principal purpose is to process transactions for Paytm. The RBI notice will now stop this bank from offering many banking services, including accepting fresh deposits and credit transactions across its services.

The public inconveniences

How will the people be affected? As of now, what comes to the surface are transactions that are routed through the payments bank. Paytm is the largest issuer of FASTags for automobiles, and this will be hit severely after the February 29 deadline. Banks also provide FASTags, but Paytm FASTags has been the most popular. That will change.

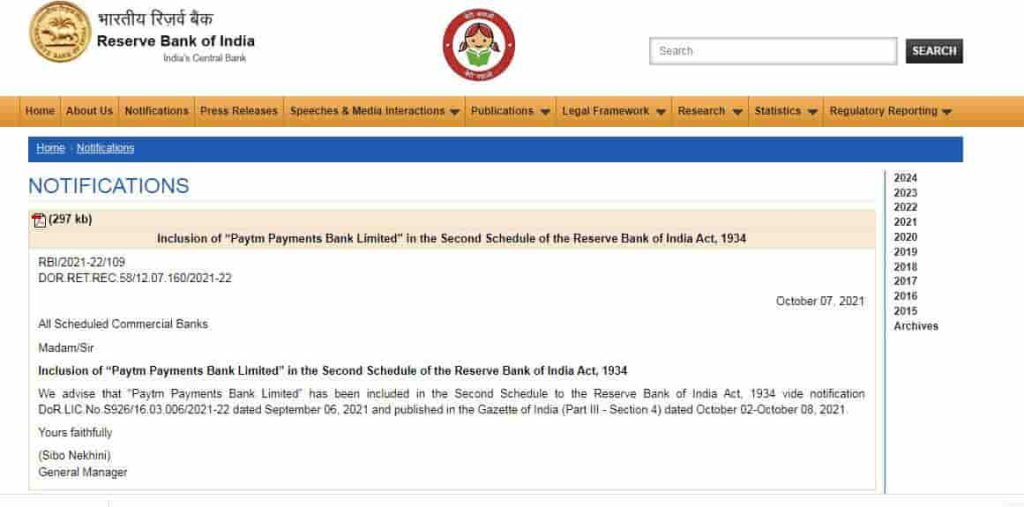

It was on October 7, 2021, that the RBI issued a notification regarding Paytm Payments Bank Limited. That was the beginning of the bank’s journey

The issue of loans from Paytm bank is somewhat of a misnomer. Paytm Bank does not provide loans itself, because it does not have the authority to do so. It has tie-ups with other banks and NBFCs—the IndusInd Bank is one among them—and Paytm is a facilitator, providing the bank its massive customer (user) base (which stands at 9.3 crore average monthly users now) for a commission.

If you were wondering how the United Payments Interface works for free when all cards, be them credit or debit cards, charge a processing fee, these are some of the special features of these electronic payments systems in India that earn the fintech companies profit.

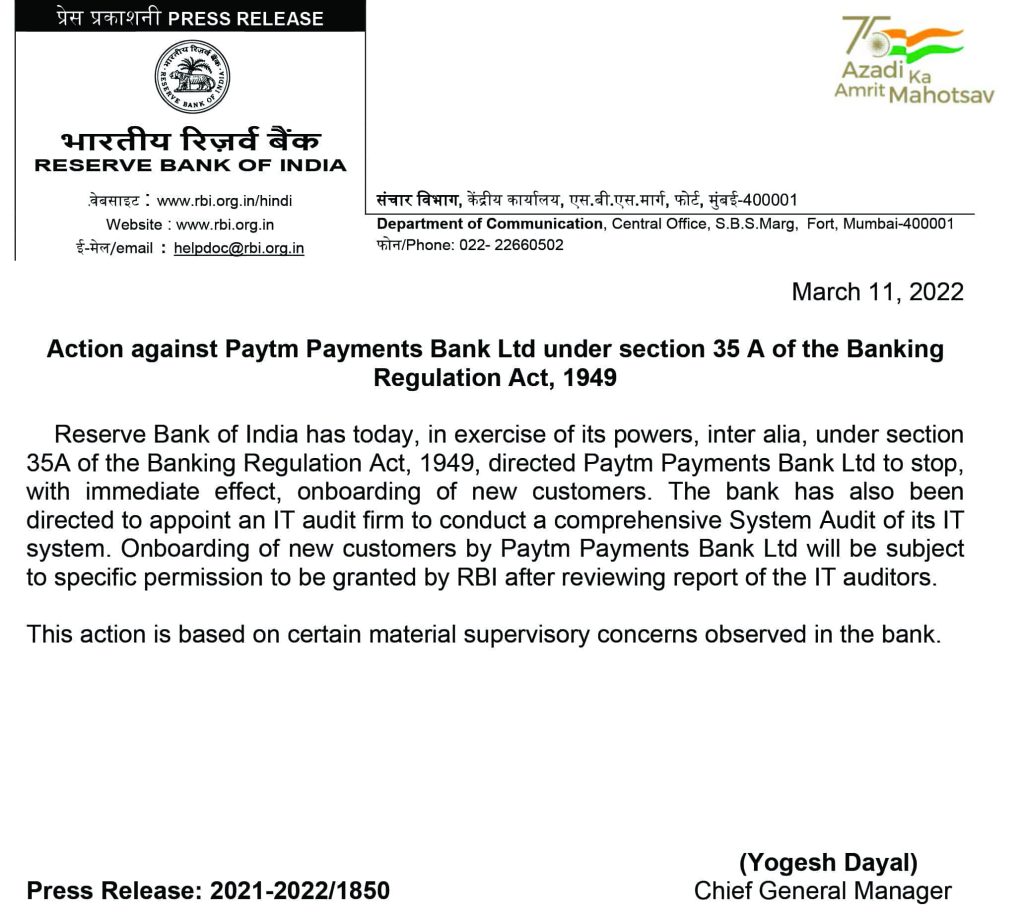

This is not the first time that the RBI has taken Paytm Bank to task. This time, the central bank said a validation report of the external auditors revealed “persistent non-compliances and continued material supervisory concerns in the (Paytm Payments) Bank”, thus forcing it to take such a drastic action.

That forced the central bank to order that no further deposits, credit transactions, or top-ups will be allowed in any customer accounts, pre-paid instruments, wallets, FASTags, NCMC cards, etc., after February 29, 2024, other than any interest, cashbacks, or refunds that may be credited anytime.

Paytm has informed exchanges that it is “taking immediate steps to comply with RBI directions, including working with the regulator to address their concerns as quickly as possible”. By that time the markets had trashed Paytm shares as fast as it could.

Many founders, however, have criticised the central bank, calling its action “hash”. Deepak Shenoy, CEO of Capitalmind has been quoted as saying: “Can’t believe the RBI would just go destroy a bank like this. When Yes Bank had much bigger issues they took over and got other banks to take over. To protect the system, they ensured a smooth transition in 15 days. But, now they prefer to let all the bank’s customers, vendors and partners suffer and create a confidence issue unnecessarily, and force the business down.”

A matter of national pride

Paytm may have built itself up on political positioning and a bit of patronage, but that it has been one of the jewels on the UPI crown cannot be denied. So, why was this drastic action taken on what was not so long ago a matter of national pride?

Frankly, it was exactly that reason that led to the RBI’s tough action. A day before this year’s Republic Day parade, French President Emmanuel Macron was taken to a Jaipur market by Prime Minister Narendra Modi where the two had two cups of steaming Indian chai. In the end, the publicity material that emerged from that exercise was Modi paying the chaiwallah using a UPI app.

India has been tom-tomming this great Indian venture across the world, and France has shown interest in buying it. President Macron was impressed by what Modi did and India wants to make sure that what India wants to sell across the globe must not have any company smearing the reputation of UPI. Hence, possibly, the action on Paytm by the RBI.

For all practical purposes, however, while India has opened to the market several ventures, including in the defence sector, when it came to banks, Indian authorities have been extremely careful to allow new entrants. While existing banks—especially PSU banks—have been defrauded to the bone, piling up mountains of NPAs that needed major rescue efforts, vetting of new banks has always been severe and slow.

The inclusion and the IPO

It was on October 7, 2021, that the RBI, issued a notification to “All Scheduled Commercial Banks”. The notification said:

“Inclusion of ‘Paytm Payments Bank Limited’ in the Second Schedule of the Reserve Bank of India Act, 1934.

“We advise that ‘Paytm Payments Bank Limited’ has been included in the Second Schedule to the Reserve Bank of India Act, 1934 vide notification DoR.LIC.No.S926/ 16.03.006/2021-22 dated September 06, 2021 and published in the Gazette of India (Part III – Section 4) dated October 02-October 08, 2021.”

That was the beginning of the bank’s journey.

In November that year, One 97 Communications Ltd IPO happened. The IPO was oversubscribed by more than 10 times, indicating strong investor interest. However, the listing was poor. It listed at around 9% discount at Rs 1,955 against its issue price of Rs 2,150 on the BSE and National Stock Exchange (NSE) and clocked as much as 27% loss during afternoon trading.

Within just a few days of its IPO, PayTM’s stock price plummeted, resulting in significant losses for investors. The company’s stock price dropped to INR 1,385, a decline of over 35%.

At the last count, after the RBI notice and the market scare, Paytm shares were standing at Rs 487.20.

Warnings and penalties

The going was getting tougher by the day, especially with many more payment gateways doing stellar business in India.

On October 10, 2023, the RBI, through an order, imposed a monetary penalty of Rs 5.39 crore on Paytm Payments Bank Limited “for non-compliance with certain provisions of the ‘Reserve Bank of India (Know Your Customer (KYC)) Directions, 2016’, ‘RBI Guidelines for Licensing of Payments Banks’ read with ‘Enhancement of maximum balance at end of the day’, ‘Cyber security framework in banks’ read with ‘Guidelines on reporting of unusual cyber security incidents’ and ‘Securing mobile banking applications including UPI ecosystem’.”

That was an indicator of things to come. However, Paytm’s Sharma may have thought the company could get away by just paying a fine. On January 22, in Ayodhya, when the PM was inaugurating the Ram Mandir, Sharma was there to not only sing paeans, but also to promote his company. That proved to be a Band-Aid on a serious wound and did not hold.

The final tally

This disaster of One97 and Paytm will, however, not immediately affect any customer involved with the Paytm Bank. All the deposits and loans will be in place for the time being, none of their values being affected, unless they are linked with Paytm shares.

Even during the penalty order, the RBI had mentioned: “This action is based on the deficiencies in regulatory compliance and is not intended to pronounce upon the validity of any transaction or agreement entered into by the bank with its customers.”

Paytm could still come back and play a role in the system, but the road ahead of it now is so steep that it could prove pretty difficult.