From fighting black money to leading the nation into a cashless era, the government’s demonetization drive has taken a sharp turn, plunging the nation into troubled times

By Ajith Pillai

From fighting the scourge of black money to heralding a brave new cashless digital era, the government’s demonetization drive has seen several sharp twists and turns. As many as 50 new announcements have punctuated the one month since the Rs 500 and Rs 1,000 currency notes ceased to be legal tender from November 9.

The rash of revisions and counter-revisions pertaining to the defunct currency and the terms of returning it is seen by many within the government as a manifestation of the abysmal lack of planning that went into the exercise. The aftershocks of India’s financial 9/11 continue to shake the nation as it enters the second month of disruption without a pause.

The confusion within the government was best explained to India Legal by a finance ministry official. “None of us knew anything about what was coming. We first heard of it on November 8 when the PM made the announcement. I don’t think even at the secretary level, people knew about it. The entire decision-making process was bypassed. One understands that demonetization was not discussed in the cabinet or at the Cabinet Committee on Economic Affairs (CCEA). We were simply shocked, although many of us wondered at the outset as to how demonetization could help fight black money. But we thought the entire plan must have been thought through. Now we know it was not.”

KEPT IN THE DARK

In fact, there is a buzz within the bureaucracy that perhaps even Union Finance Minister Arun Jaitley was kept in the dark till the very last minute. This speculation has gained a degree of legitimacy after West Bengal Finance Minister Amit Mitra revealed to TV host Karan Thapar in an interview on December 8 that a senior cabinet minister had told him how the entire cabinet was kept out of the loop.

Said Mitra: “I must confess that a Union cabinet minister said to me that they (the entire cabinet) were taken to a room and they thought the PM would speak to them. But that did not happen. Instead, they saw the Prime Minister on the TV screen making the announcement to the entire nation. They heard about it (demonetization) like all of us—at the very same time.”

Demonetization’s downside

- If GDP declines by 2 percent, as predicted by Dr Manmohan Singh, it translates into a loss of around Rs 3 lakh crore. If it goes down by 3.2 per cent, as suggested by others, then the loss would be about Rs 4.75 lakh crore.

- Demonetization could take away 4 lakh jobs in the next one year. Sectors where jobs will be affected include e-commerce, luxury goods stores, shopping malls, textiles and garments industry, tourism, hospitality business and aviation.

- Employment opportunity in the unorganized sector, which accounts for over 90 percent of India’s work force, is fast drying up. Those affected are in the agriculture sector, fisheries, construction work, manufacturing and services.

- Several hawkers and those plying trade have seen a sharp drop in business. Many have had to return to their villages.

- Several sectors are bracing for a downturn in business, including small-scale industries, leather, automobiles, real estate, diamonds and gems, cement, steel, consumer durables, FMGC and the retail business.

- The rural economy is reeling under the shock of notebandi. Farmers are finding it difficult to sell their produce at mandis because of the cash crunch. Organizing funds for inputs like fertilizer has become very difficult.

When asked about the identity of the minister, Mitra said he was referring to a “very senior member of the cabinet” and that he had met him at a GST Council meeting in Delhi in the first week of December. The inference drawn by many was that the minister in question could be none other than Jaitley.

A day after Mitra’s disclosure, a Reuters report surfaced throwing light on the man behind the demonetization drive. He was identified as Union revenue secretary Hasmukh Adhia. A 1981 batch IAS officer, he was principal secretary to Narendra Modi from 2003-2006 when the latter was Gujarat chief minister. Adhia, a gold medalist from IIM-Bangalore and a PhD in Yoga from Swami Vivekanand Yoga University, Ban-galore, enjoys the trust of the prime minister.

Adhia took over as revenue secretary in September last year and officially reported to the finance minister. But for all practical purposes, he worked under the PM. He and five others, sworn to secrecy, and a team of researchers operated out of 7 Race Course Road. They comprised the team that planned the demonetization exercise and included data crunchers and those associated with Narendra Modi’s social media campaign in the 2014 general elections.

According to sources, the group zeroed in on demonetization for the following reasons: (a) it would root out black money by rendering undeclared income in high denomination notes invalid and unusable; (b) ensure liquidity in banks reeling under Non-Performing Assets amounting to over Rs 6.30 lakh crore; (c) it would derail the election plans of opposition parties and immobilize a big chunk of their funds in two key poll-bound states—UP and Punjab.

D-DAY ADVANCED

The original plan was to explode the “D-Bomb” on November 18, a Friday. It was felt that this would give a breather to banks to swing into action over the weekend. However, the date was advanced to November 8 because of fears that the news may be leaked to the media and would enable black money hoarders to convert their loot to white.

Much of the groundwork for the “surgical strike” was done by Adhia’s team. Data on time taken to print and distribute new notes was collated. Notes were prepared on the

after-effects of demonetization and how it would impact various sectors and how banks would benefit from a sudden inflow of funds. Everything was factored in except one crucial aspect—the overwhelming dependence of the ordinary citizen on the Rs 500 rupee in

day-to-day financial transactions.

A former bureaucrat in the know told India Legal: “The calculations were made rather haphazardly. I believe that if the plan had been discussed in the finance ministry, the glaring loopholes would have been pointed out. Similarly, had the CCEA been taken into confidence, it would have raised several objections and pointed out the pitfalls. But that did not happen. I understand that even the RBI was informed about the introduction of new notes but very few people in the central bank were aware of the enormity, suddenness and scale of the demonetization exercise.”

In retrospect, the black money math was rather simplistic. It was initially assumed that of the Rs 15.44 lakh crore of high denomination notes in circulation, not more than Rs 8-9 lakh crore would be returned to the banks. The unreturned (about Rs 5 lakh crore) money would constitute the black component in circulation that could be declared neutralized. This is the money that the government hoped it could leverage for development work and to kick-start the economy.

NARRATIVE CHANGES

However, it became clear within a fortnight of demonetization that no significant amount of black money has been neutralized. It became evident by the volume of deposits in banks that much of the money in circulation would be returned. So the black money vanquished through demonetization would not be big enough to trumpet about and score political brownie points.

The narrative had to be changed. By November 20, the punchline was no longer a “war on black money”. It had changed to a “march towards a cashless economy”. The prime minister’s speeches suddenly became less focused on black money, although he continued to berate those who opposed notebandi as belonging to the corrupt class.

Meanwhile, a month into demonetization, only 30 percent of the money that had been declared illegal was replaced with legal tender by the RBI. The result: a severe cash crunch that hit practically every strata of society, more so the poor. Queues at banks and ATMs have shown no signs of shrinking and news that it would take at least six months for normalcy to return spread panic. People began to hoard acceptable currency at home and became austere in their spending—an unwelcome sign for a growing economy.

Even the IT raids on black money publicized in the media were due to established methods of detection and not thanks to demonetization. What’s worse, in many of the raids, the black money unearthed was in the new Rs 2,000 notes or its counterfeits. So the introduction of new currency did not deter fraudsters.

Jio joins the pack

On November 10, two days after demonetization was announced, a new entrant to the payments bank sector was incorporated. The outfit, Jio Payments Bank Ltd (JPBL), is a joint venture of Reliance Industries Ltd and State Bank of India. The company has received initial approval from the RBI to operate.

The fact that Reliance Jio has tied up with SBI, the largest PSU bank, is considered significant. Many industry sources say that the newly incorporated company may be the largest beneficiary of the government’s cashless drive given the nationwide network of the SBI.

According to details submitted to the Registrar of Companies, JPBL has seven directors on its board, including SBI’s deputy managing director (Corporate Strategy and New Business) Manju Agarwal. No date has been fixed for the formal launch of the bank but its entry is expected to be a game-changer and a big plus for the Reliance group.

Frustration soon began to rear its head. V Ranganathan, a former IIM professor who initially backed the demonetization drive, had this to say: “I now feel like kicking myself. I was among the first to welcome the initiative on November 9. I thought the PM and his team had all the logistics worked out and the plan would roll out in an acceptable manner. Today I feel like an idiot. And the unfortunate part is the man on the ground thinks that the rich guy is getting screwed so it is worth paying for. The poor sucker does not know that it’s people like him from the lower strata who are getting screwed.”

Slowly but surely, the tide began to turn. A Huffington Post-Business World-C Voter survey on December 8 across India sho-wed that sentiment was swinging against the demonetization drive in both rural and urban India. While people were highly supportive of the government in the first two weeks, the continuing cash crunch and the prolonged disruption of their lives was testing their patience. However, they still were with the BJP given the disarray in the opposition.

ECONOMIC EMERGENCY

The paucity of cash in banks imposed a recession and an undeclared economic emergency in the country. The farming community is in dire distress with cooperative banks cashless and non-functional, several small-scale sector units have had to shut shop and the unorganized sector is in total disarray. Industrial production has plummeted and daily wage earners have no source of employment. There is chaos all around.

In fact, one question that looms large in many minds is this: If the objective of

demonetization was not fighting black money but to only transform India into a cashless and digital economy, then was it worth all this pain and suffering?

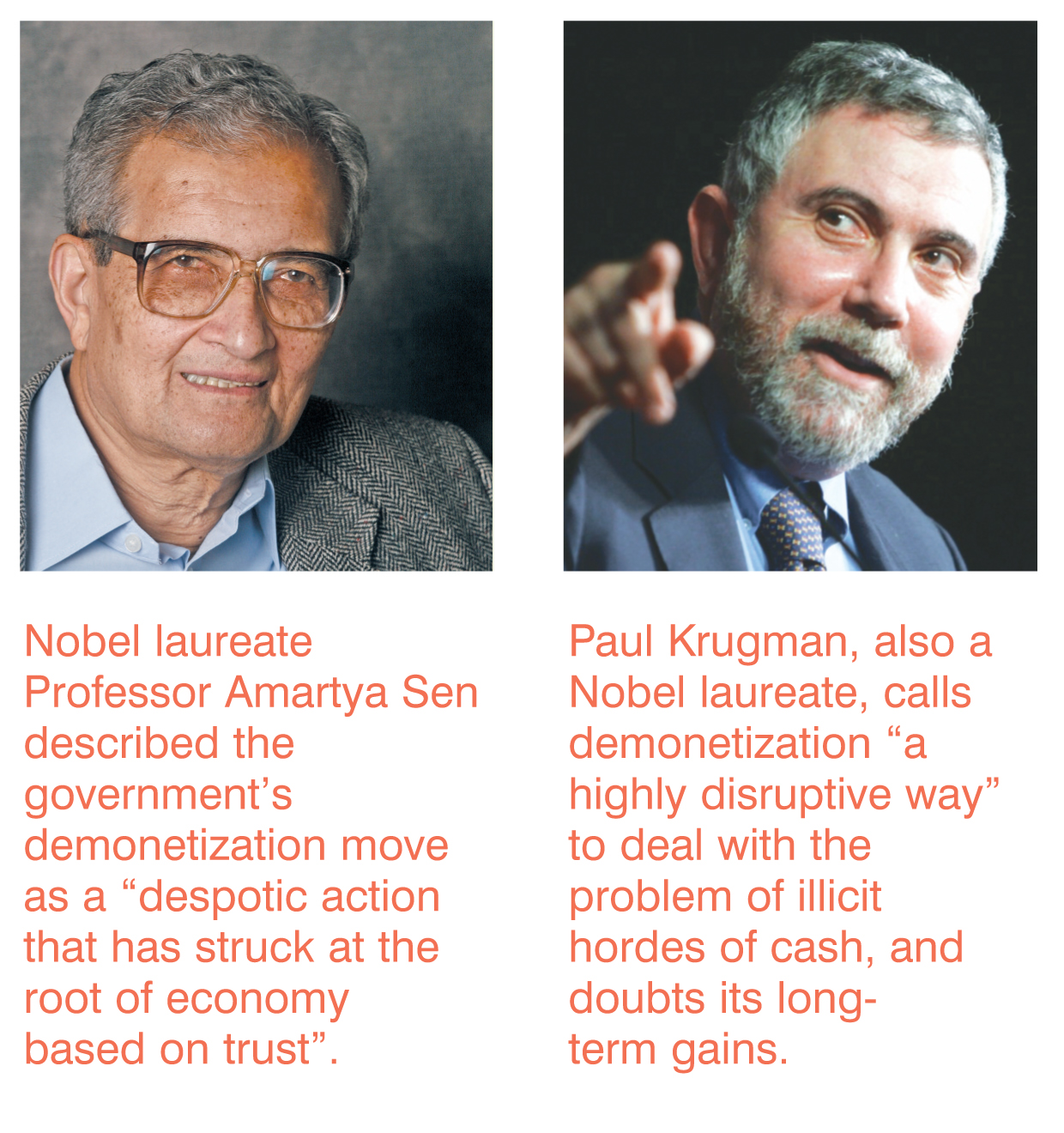

The government has not been forthcoming in providing answers. Instead, cabinet ministers and party spokespersons have been spreading Modi’s gospel of a cashless society across the country. Typically, Commerce Minister Nirmala Sitharaman described demonetization a digital detergent that would clean the economy. “This large, bold and historic initiative was taken by the Prime Minister keeping in mind the long-term economic future of India,” she said. Power minister Piyush Goyal described demonetization as “innovative disruption” while dismissing the criticism of two Nobel Laureates—Amartya Sen and Paul Krugman —as views of people who “either do not understand the Indian psyche” or are “seized by Modi-phobia”.

The government has not been forthcoming in providing answers. Instead, cabinet ministers and party spokespersons have been spreading Modi’s gospel of a cashless society across the country. Typically, Commerce Minister Nirmala Sitharaman described demonetization a digital detergent that would clean the economy. “This large, bold and historic initiative was taken by the Prime Minister keeping in mind the long-term economic future of India,” she said. Power minister Piyush Goyal described demonetization as “innovative disruption” while dismissing the criticism of two Nobel Laureates—Amartya Sen and Paul Krugman —as views of people who “either do not understand the Indian psyche” or are “seized by Modi-phobia”.

Professor Amartya Sen had described the government’s demonetization move as a “despotic action that has struck at the root of economy based on trust”. And Krugman pointed out that demonetization “seems like a highly disruptive way to deal with the problem of illicit hordes of cash, though it is not clear what significant long terms gains will come of it”.

HUGE TASK

So, what does one make of the march towards a cashless economy? Like the fight against black money, it too is a laudable objective. But a shift from cash to a digital economy cannot be achieved overnight. It will take a lot of doing for a 120-crore plus population to embrace a new system of transaction when close to 90 percent retail transactions are currently in cash. In fact, it could take several years even if the committee set up under Niti Ayog’s chief executive officer Amitabh Kant takes on the task of “making India a cashless economy on a war footing”.

The following factors point to the enormity of the task ahead:

The following factors point to the enormity of the task ahead:

- In the US which has been encouraging digital spending for decades, the cash component has only been increasing. A report in The New Yorker magazine in April quotes official figures and notes that in the last two decades, US currency in circulation has more than tripled to about $1.4 trillion, mostly in $100 bills. Given this, can India turn cashless overnight?

- The Indian spin that we are better poised to go digital since the number of internet users in India is higher than in the US is misleading. Figures quoted in the website Indiaspend note that with 34.2 crore internet users, we may have overtaken the US but this impressive figure only represents 27-28 percent of our population. This means that 73 percent Indians have no internet access. Also, of the total 34.2 crore net users in the country, only 13 percent are in rural India.

- India may have 102 crore mobile subscribers but only 17 percent adults have smart phones which can download apps. So the task of turning India digital is stupendous.

- Even the spread of banks is such that of the 1.38 lakh branches, only 47,000 are in rural India. The spread of ATMs is also skewed with 90 percent in 16 states and a sizeable number in urban centers.

- lA huge majority of the unlettered population do not trust banks and find it inconvenient to operate accounts. One estimate is that 80 percent of the population for all practical purposes are unbanked.

- The push towards a digital economy will increase cyber crime which India is not equipped to handle.

The digital push will, no doubt, boost the business of existing and newly formed (see box) electronic financial payment companies. Many of them have already begun reporting a huge spurt in business since demonetization and have begun to heavily advertise their services in the media. But could the drive towards a cashless economy have been achieved without the pain of notebandi? Economic commentator and editor, TN Ninan puts it rather succinctly: “These objectives (establishing a digital economy and introducing tax reforms) could have been done independent of notebandi, which, at this stage, looks like a bad idea, badly executed on the basis of some half-baked notions.”

Lead picture: Waiting for hours in queues to get Rs 2,000, only to return empty-handed on many occasions, added to the frustration of people. Photo: Anil Shakya