The Nirav Modi-PNB scam and others before it have shown that lax corporate governance, dishonest officials and suave rogues have bled the banking sector, leading to huge NPAs. Nothing short of drastic reforms and punishment will clean up this vital sector

~By Kingshuk Nag

In a TV discussion post Nirav Modi, one panellist pointed out how none of the three last RBI governors who wrote books—where they discussed banking and other matters—referred to the rising NPAs (non-performing assets) at any great length. This is a trifle strange considering that the bad debts of banks is growing exponentially and stands at a staggering Rs 9.5 lakh crore presently! Considering that loans of Rs 6 lakh crore have been written off in the last few years, this would imply that NPAs would be Rs 15.5 lakh crore. “They are standing on Eiffel Tower and their vision does not extend to the happenings on the ground,” wryly comments former managing director of State Bank of Hyderabad Santanu Mukherjee. By implication, when the chief regulator of the banking system is not focused on rising bank scams, the entire system is lax—right down to individual banks.

In an honest system, an NPA reflects the inability of the loanee to pay back what he has borrowed due to the failure of the business in which the money is invested in. But in India, many NPAs are because the intention of the loanee may be to defraud the system. “Loans are given against collaterals such as plant and machinery. Often times, they are overvalued on books with the connivance of bank managers to get a higher amount of loan. Project costs are overstated and some part of the loan from banks is siphoned off by promoters,” says an assistant general manager of State Bank of India (SBI) who didn’t want to be named. “This process of obtaining fraudulent loans has accelerated since 2002-03 when a group of specialised investment managers has emerged. Some of them liaise with banks to procure funds for projects which might not be financing worthy,” says Amitabha Guha, a retired deputy managing director of SBI.

In this scenario, the Nirav Modi-PNB scam has added a new dimension to bank frauds. The basic facts about the fraud—which have now been widely discussed—centres on the Letters of Undertaking (LoU) issued by the Brady Road branch of Punjab National Bank (PNB) in Mumbai in favour of diamond trader Nirav Modi’s companies without insisting on any collateral since 2011. What is more, deviating from the normal practice of giving LoUs to diamond exporters for only 90 days, PNB was extending it for 365 days for Modi’s companies. The scam is preliminarily estimated to be over Rs 11,000 crore. With the LOUs—by which PNB stood guarantee—Nirav Modi’s companies were able to get loans from banks to whom they were issued. These include Union Bank, Axis Bank, Allahabad Bank, Canara Bank and the Bank of India.

Though the loans were made to purchase diamonds overseas, it is suspected that much of it was diverted for other uses. Also named with Nirav Modi in the FIR filed by the CBI is his maternal uncle, mentor and partner Mehul Choksi.

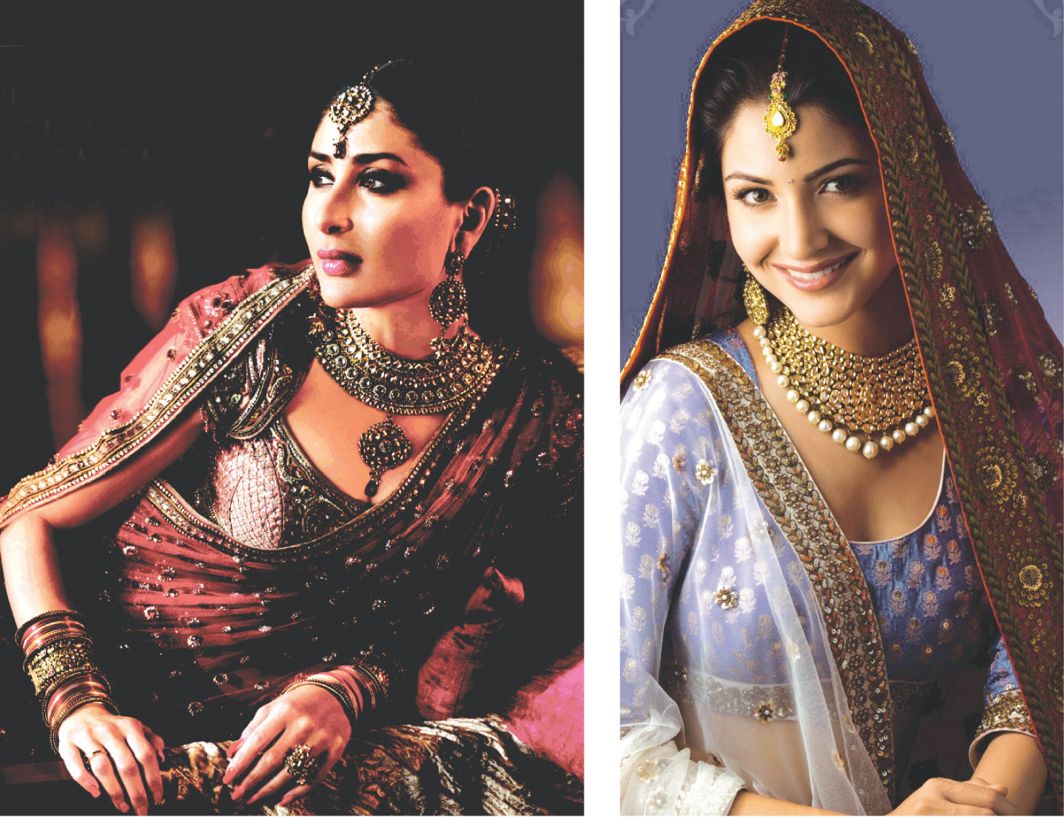

He is believed to be the mastermind of the high-profile business that had roped in top Bollywood actresses like Priyanka Chopra to endorse the brand of diamond jewellery that went by Nirav Modi’s name (see box).

Brands and their ambassadors

In the light of Nirav Modi’s Rs 11,300-crore fraud on Punjab National Bank (PNB), it was reported that actress Priyanka Chopra, who was the brand ambassador for Nirav Modi Jewels, may cancel and terminate her contract with his company.

In the light of Nirav Modi’s Rs 11,300-crore fraud on Punjab National Bank (PNB), it was reported that actress Priyanka Chopra, who was the brand ambassador for Nirav Modi Jewels, may cancel and terminate her contract with his company.

Her legal team has charged Modi with defrauding her and not paying her dues for endorsement and an advertisement that also featured actor Sidharth Malhotra, who is also planning to sue Modi for the same reason.

In this regard, two legal issues arise: What is the liability of the brand ambassador in this case and under which section of the Indian Contract Act can Priyanka sue Modi for non-payment of dues?

Liabilities of a brand ambassador are covered wholly by the contract between the endorser and the company and with each brand, the terms and conditions vary. In this case, Modi is liable for the fraud committed against PNB. But as this is not related directly with Nirav Modi jewellery, Priyanka is not liable.

When a brand ambassador finds out about the fraudulent nature of the owner of the company he/she endorses, he/she is at liberty to end ties with the brand. There have been other examples of celebrities ending their contract for the same reason. For example, cricketer MS Dhoni ended his association with the Amrapali Group and Amitabh Bachchan with Nestle after the Maggie noodles scandal broke out. Nonetheless, in June 2017, an FIR was registered against Bachchan for endorsing Maggi.

Coming to Priyanka, she can sue Ni-rav Modi under Section 73 of the Indian Contract Act that deals with breach of contract. This section provides that if one party fails to perform his or her duty, then other party is at the liberty to end the contract and claim compensation in case some damage has been incurred.

—By Srishty Raj

The scam was enabled by an international system called SWIFT (Society for Worldwide Interbank Financial Telecommunications) which was set up in 1973 with its headquarters in Belgium. This platform is used by 11,000 financial institutions in 200 countries and territories to facilitate swift transfer of funds. This, in turn, enables easy business transactions.

Compared to 2.4 million SWIFT messages per day globally in 1995, the number has shot up to 17 million per day. Due to the sheer volumes of the messages, it is imperative that banks which use SWIFT have a strong regulatory mechanism. PNB obviously did not have any. As a result, deputy manager Gokulnath Shetty was able to send messages using his SWIFT code but bypassing the official system.

“When funds are transferred on the basis of a SWIFT message, there should be a counter entry in the Nostro account to reflect the foreign currency transfer. In all fairness, due to the huge volume of SWIFT messages, there is a gap in the reconciliation of accounts which should be done at the end of the day. The shortage of staff is the prime reason for this,” confides a deputy general manager of the Bank of Baroda. “We have now been advised post the PNB scam that the reconciliation should be on a daily basis,” says a senior manager of SBI. He adds: “Let’s see whether this can be done effectively with such huge volumes.”

Although the original assessment was that a compromised Gokulnath Shetty was acting solo, this view had to be revised. First, he had been on the same desk for seven years, helping him cover his tracks. The issue was who allowed him to continue undisturbed for so long on the desk and how come nobody noticed the huge transactions. “There were huge supervisory lapses. No processes were being followed. Huge credits in the Nostro account should have stood out like a sore thumb to the top management and the board. The entire lot should be sacked and criminally prosecuted,” says a long WhatsApp message doing the rounds in PNB after the scam broke out. “I don’t think the chairman of PNB should have reason to know, but certainly it should have come to the notice of the general manager or module head who is the brand controller and supposed to independently inspect the branch once in a quarter,” says Guha, who incidentally was deputy managing director in charge of inspections (internal audit) at SBI before retirement. After Shetty, many other officials of PNB have been arrested.

For decades together, the SWIFT system of transmitting messages was reputed to be foolproof, but now with the PNB scam, there is suspicion that similar frauds may be taking place in other banks undetected.

In fact, proof of it came barely days after the PNB scam when a small private bank, City Union Bank, reported that it suffered “three fraudulent remittances of nearly $2 million”, and that “no entries were made in the ledger of the banks and had been pushed through SWIFT”. Though no official was named in the fraud, City Union Bank also had its equivalent of Gokulnath Shetty.

“Scams are rising because the quality and integrity of senior managers in banks is declining. When a young man joins as a Probationary Officer, he is full of enthusiasm. But very soon, he falls in line with the system where promotions depend on the bosses, many of whom are compromised. And the more senior he becomes, the more compromises he has to make,” says a 55-year-old chief manager of a PSU bank who found himself at the wrong end of the stick because of his inability to make compromises.

“It is different from the government where directly recruited Grade A (Class One) officers will go up to a fairly senior position on a time scale before ‘selections’ are kicked off. For IAS and other central services officers, this will be from the level of joint secretary. So you are at nobody’s mercy and can be honest. But in PSU banks, you are at the mercy of bosses from your first promotion onwards,” says a management officer of UCO Bank.

The most telling example of how top bank managers compromise is demonstrated by how Vijay Mallya secured a Rs 950 crore loan from IDBI Bank in 2009. By then, Kingfisher Airlines was already making huge losses and eroded its entire capital base and no banker in his proper mind would loan out money for the ailing company. At this point, Mallya, who was also a Rajya Sabha MP, approached IDBI Bank. Its chairman, Yogesh Agarwal, was allegedly spoken to by someone who mattered in North Block. Believed to be a highly ambitious man, Agarwal started off as a probationary officer in SBI and rose to the level of managing director, but desired to be chairman. However, he was beaten to the post by his batchmate, OP Bhatt. Agarwal left SBI to join IDBI as the top boss. The help of crucial North Block officials was of prime importance here.

On examining Kingfisher Airlines’ papers, Agarwal realised that the airline could not be lent money without proper collaterals. Strangely enough, Mallya’s team came out with a report from a foreign consultant that valued the net worth of the Kingfisher brand name at Rs 4,000 crore! On this basis, IDBI loaned Rs 950 crore to Kingfisher to shore up its operation. But according to an Enforcement Directorate chargesheet in 2017, the top management of IDBI Bank conspired with Mallya to give out this loan. Much of the loan amount was not used for reviving Kingfisher but diverted for other purposes and some of it was transferred overseas, as per the chargesheet. Agarwal was made the chairman of Pension Fund Regulatory and Development Authority after he retired from IDBI. He was arrested after Mallya scooted from India and there was ruckus about la-affaire Kingfisher.

The Indian government is now fighting a legal battle in a London court to extradite Mallya. But the way it is proceeding, there is little hope of getting Mallya back home. Similar may be the case with Nirav Modi. There are rumours that he may be holed up in either Dubai, New York or Hong Kong. Wherever NiMo, the new nickname for Nirav Modi, may be hiding, he is still showing the thumb at PNB. In a letter to PNB after the scam broke out, he asserted that the bank’s “overzealousness” had shut the doors on his ability to clear dues (that he claimed was only around Rs 5,000 crore) by damaging the brand value of his businesses.

In the case of another absconder, Jatin Mehta, he and his family are holed up in St Kitts in the Caribbean islands with whom India has no extradition treaty. Mehta was the promoter of Winsome Diamonds and Jewellery Limited and had defaulted on repayment of a Rs 7000-crore loan granted by a consortium of banks led by PNB.

After keeping mum for a few days, finance minister Arun Jaitley on February 20 blamed the management and auditors for the scam. This was even as the RBI came out with a statement that it had thrice warned banks since August 2016 that a potential abuse of SWIFT could take place. Meanwhile, Prime Minister Narendra Modi is sought to be embarrassed by a group photo with Nirav Modi at the World Economic Forum in Davos on January 23.

However, this is of little solace to tax payers who will have to bear the brunt of the colossal loss in the balance sheet of PNB and other nationalised banks hit by the NiMo scam. Last October, Jaitley had announced a Rs 2.11 lakh crore bank recapitalisation plan over the next few years to shore up the capital of PSU banks. Out of this, Rs 88,139 crore was to be infused in financial year 2017-18 that closes March-end.

IDBI Bank (swindled by Kingfisher Airlines) is to get Rs 10,610 crore, while PNB is to get Rs 5,473 crore. But with the latest hit, this is not going to be enough for PNB, which was founded in Lahore in 1894 as part of Punjabi renaissance. Analysts say that recapitalising banks may shore up finances but would do nothing to shore up management practices and keep bureaucrats and politicians away from messing into bank affairs.

It is easy to recommend privatization of banks but with poor corporate governance practices ailing large parts of the private sector, nothing short of radical reforms may help.