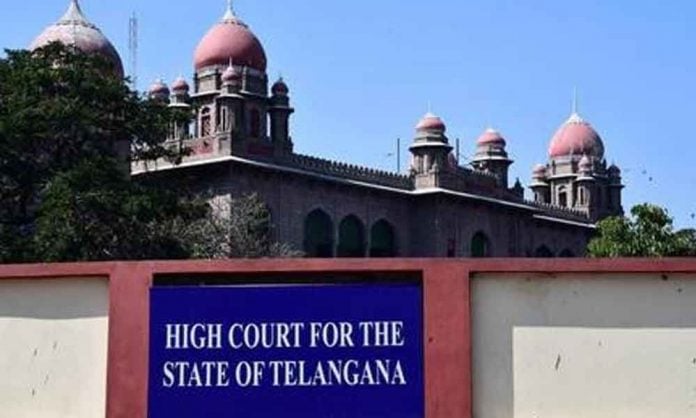

New Delhi (ILNS): The Telangana High Court in a judgment, also decreed that GST officials cannot resort to physical violence while conducting a search, investigation or interrogation.

The Division Bench of Justices M.S. Ramachandra Rao and T. Amarnath Goud passed this order while deciding a writ petition filed by the director of a company and his relative alleging that the officials belonging to the GST Intelligence Department while conducting raid assaulted them physically.

The petitioners are a Private Limited Company incorporated under the Companies Act, 1956 involved in the business of steel registered under the C.G.S.T. Act, 2017.

It was submitted by the Petitioner that without any prior intimation or show-cause notice, the officials attached to the Directorate General of GST Intelligence, New Delhi conducted simultaneous raids on business units of the petitioner company and the residential house of the director.

That the respondent authorities physically assaulted the petitioner and his relative without any regard to their old age, although the employees of the petitioner company and also the director of the company co-operated with the search operations conducted, contended by the Petitioner.

The respondent denied the allegations of the Petitioner and submitted that it was the petitioners and their employees who had obstructed the search operations and assaulted them.

The question which arises for consideration by the Court is whether officials belonging to the G.S.T. Intelligence Department of the Union of India can resort to physical violence while conducting interrogation of the petitioners and their employees in connection with proceedings initiated against the petitioners by the respondents under the C.G.S.T. Act, 2017 and I.G.S.T. Act, 2017.

The Court observed: “Though the respondents seek to suggest that such evidence procured by the petitioners ought to be disbelieved by us because Sunshine Hospital is a ‘private hospital’ and not a Government Hospital, we do not agree with such contention because there is no presumption in law that Doctors in private hospitals do not speak the truth and only Government doctors speak the truth. An injured person is likely to go the nearest available hospital for treatment instead of searching for a Government hospital at that juncture.

“If accused can get all the benefits under Art.22 of the Constitution, a person in such informal custody can say that he is also entitled to get relief under Art.21 of the Constitution of India. This view has been taken by the Gujarat High Court in Jignesh Kishorbhai Bhajiawala v. State of Gujarat while dealing with similar actions of authorities under the Prevention of Money Laundering Act, 2002,” said the bench.

The Court also took note that the respondents have a Zonal Unit at Hyderabad where they can certainly carry on any enquiries or interrogation, therefore on account of COVID -19 Pandemic situation and the high cost involved, if court allow the respondents to summon 50 or more persons in connection with the investigation of alleged GST evasion.

Read Also: Seven Strange Indian Laws You Should Know

In light of above observation the Court allowed the Petition with the direction that “the respondents shall adhere to the provisions of the CGST Act, 2017 in conducting search, investigation or enquiry in relation to the alleged tax evasion by the petitioners.”

Read the judgment here;

pdf-upload-384370