Have you heard about this tool before? It is one of the oldest and most utilized charting instruments, which enjoys demand and respect among traders, due to its simplicity and convenience. So, if you do not use it so far, it is time to learn more about how candlesticks work and which combinations they can form.

In general terms, a candlestick is an element of a specific chart type, which resembles a real candlestick by its shape and shows the following data:

- the price at the beginning of the trading period (open);

- the price at its end (close);

- the maximum value within it (high);

- the minimum rate within it (low).

If the close rate is higher than the open one, the candlestick will be white and bullish. And in the reverse situation, it will be bearish and black.

Also, one must note that thin lines between them are shadows, which are used to indicate high and low prices.

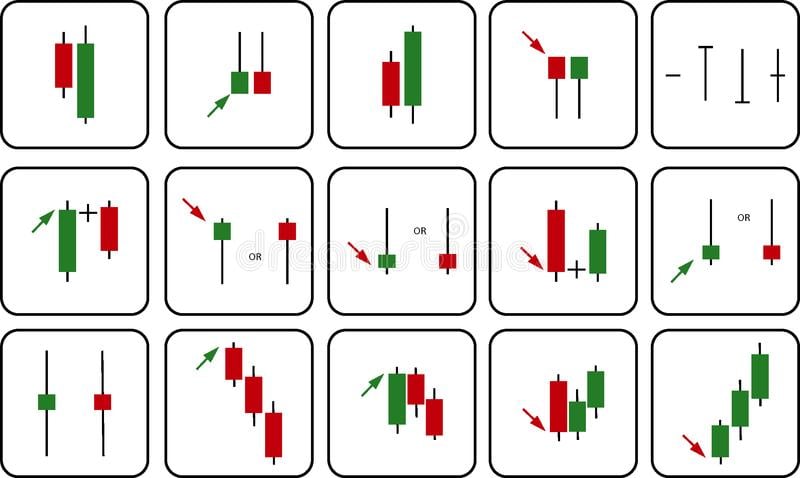

As of today, there is a wide diversity of candlestick patterns actively utilized by traders, but we have singled out the most beneficial ones for you:

- Three Line Strike. It consists of three black candlesticks that reflect the downward trend and the fourth one, which is white and reverses a situation towards a bullish pattern. In most cases that means that there is some bullish news that changed the trend on the market, turned it upwards, and contributed to the existing bearish tendency. It is time to open a long position.

- Three Black Crows. It includes three black candlesticks, which follow a previous upward trend. It points to a reversal in the current market tendency, which is most likely caused by an influential bearish event. So, the downward trend will probably continue, which means one must open a short position. There is also an opposite pattern, which is called Three White Soldiers.

- Evening Star. This term is used for the combination of three black candlesticks: the first one must manifest a rapid increase in price, the second one ― a slower rise, and the third one is wide and bearish. As a rule, the previous trend is upward. This sequence signals that the bullish tendency is changed to a bearish one. And one must open positions taking into account that the price will probably continue decreasing. The reverse situation is called Morning Star.

To sum up, candlestick charts are rather easy to read, understand, and interpret. Yet, before you implement the patterns described in real trading with your own money, you had better learn how they work via a demo account.